Hi Paul If you turn 70 in August you would receive your full age 70 rate if you claim your benefits in August and the payment will normally be issued in September. As long as you have earned income such as wages youre required to pay Social Security taxes on up to the annual payroll limitation137700.

When To Take Social Security Retirement Benefits

When To Take Social Security Retirement Benefits

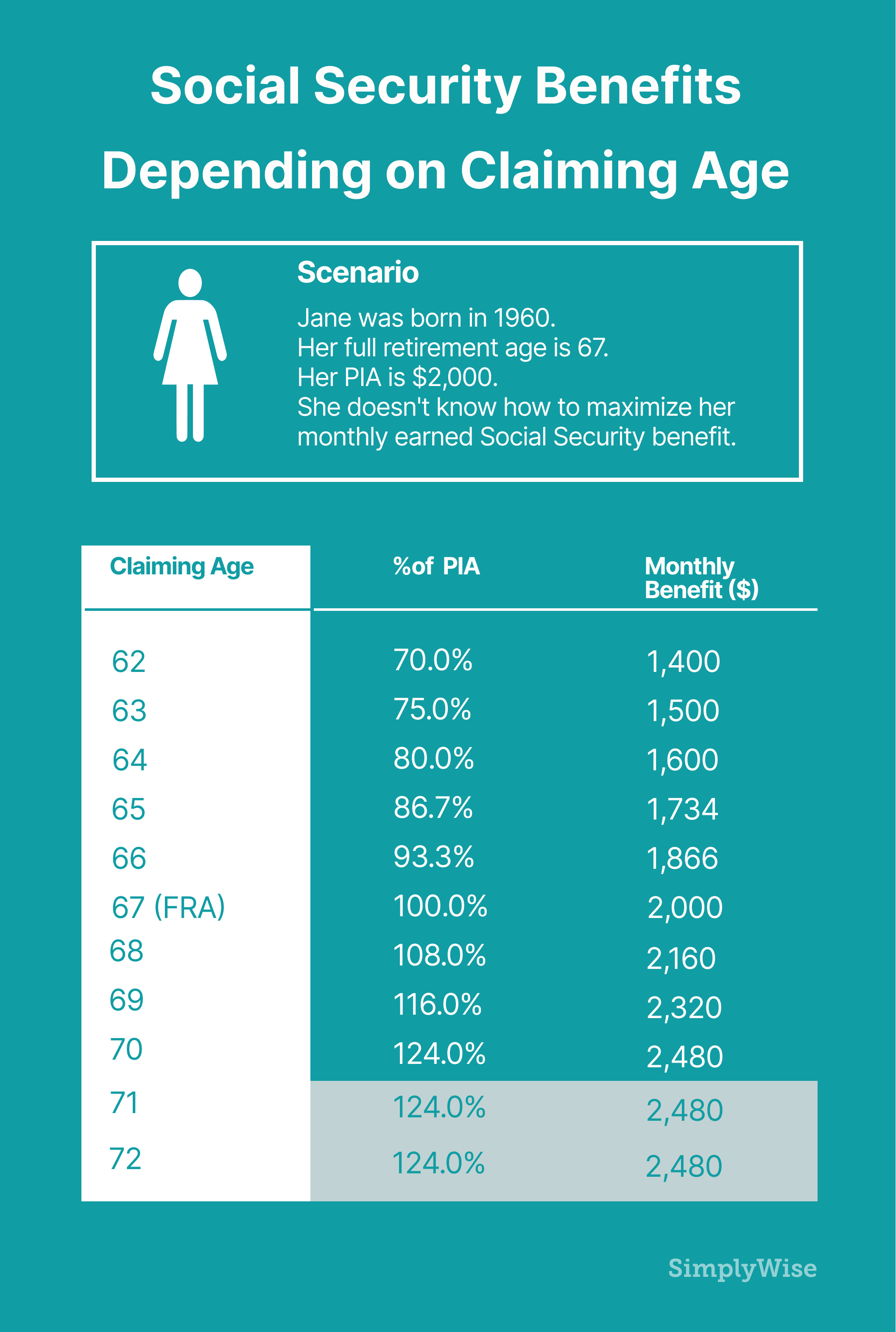

You can start benefits as early as 62 or wait as long as 70.

Social security at 70. En español The most an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is. Social Security wont automatically start sending you checks once you turn 70 with one exception. 3148 for someone who files at full retirement agecurrently 66 and 2 months.

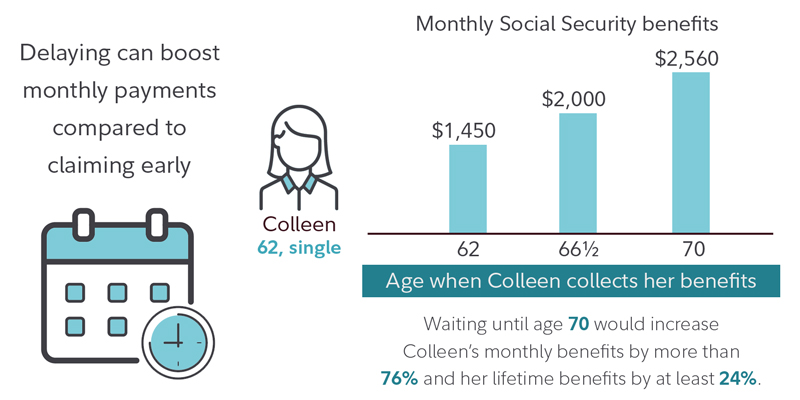

If you wait until you are 70 to take your Social Security benefit you will receive monthly payments that are 32 higher than the benefits you would. Age 70 is hardly a popular time to sign up for Social Security. Consequently if your full retirement benefit at age 66 was 1000 per month and.

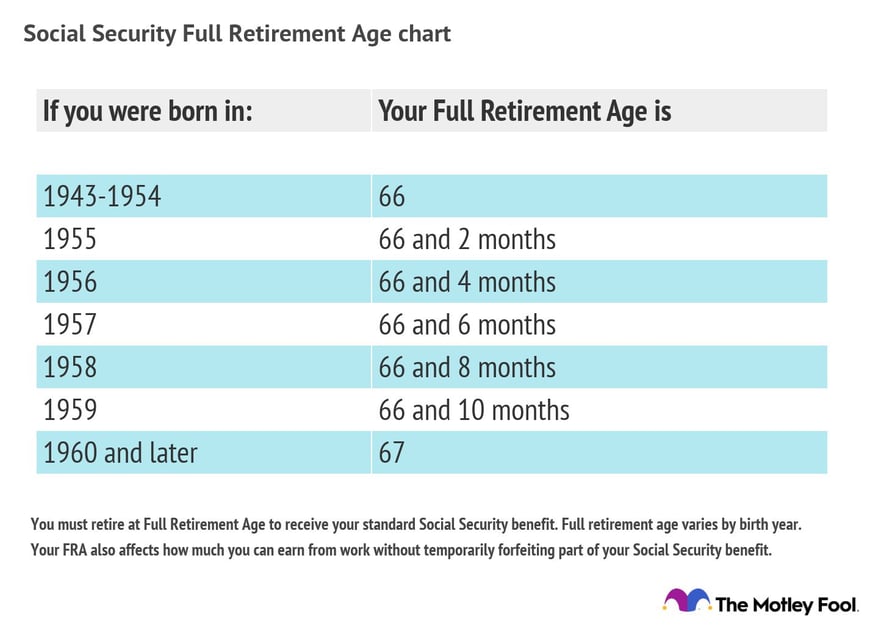

By doing so you maximized your monthly payout. Currently the full retirement age for most people is either 66 or 67 years old based on Social Security Administration guidelines. But that doesnt mean that by doing so youll wind up with your greatest total lifetime.

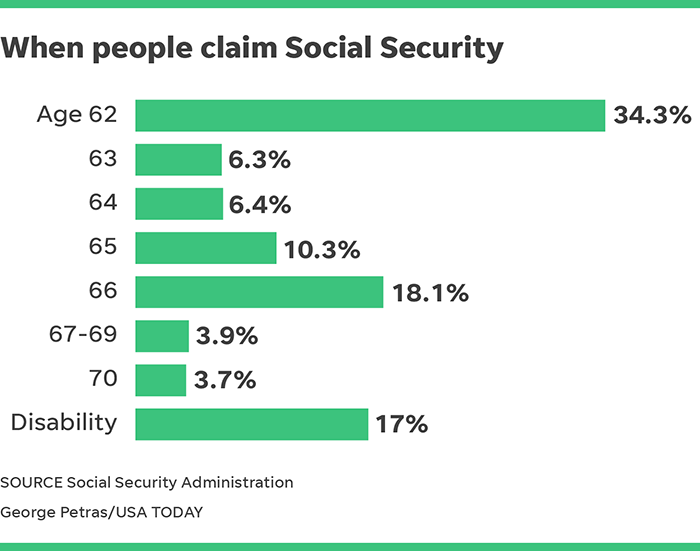

Under 4 of seniors file for benefits at that age. In 2016 just 46 percent of women and 29 percent of men first claiming Social Security benefits were age 70 or older according to the latest data from the Social Security Administration. The longer you live the bigger your advantage of delaying.

The big advantage of taking Social Security at age 70 is your benefit will be higher than it would be if youd claimed benefits earlier. 2324 for someone who files at 62. They are living longer.

When you reach age 70 your monthly benefit stops increasing even if you continue to delay taking benefits. That is no longer the case. After your Full Retirement Age of 66 or 67 your benefit goes up by eight percent each year.

If you wait until age 70 to start claiming your benefits youd receive 132 of your regular monthly benefit amount. One of the reasons why people are taking social security at age 70 and not before is simple. Thats a smart move for many folks.

And theres advantages and disadvantages associated both with claiming ASAP or waiting as. While the decision on Should You Take Social Security At Age 62 Or 70 is complex the reality is fairly simple. You dont have to be 70 for.

By contrast age 62 remains the most popular age to claim benefits despite the. Clearly waiting until age 70 to claim Social Security will result in your highest possible monthly benefit. If you decide to delay your retirement be sure to sign up for Medicare at age 65.

This represents the difference between what you would collect in any given year as a result of choosing to start social security at the age of 62 rather than at the age 70. 3895 for someone who files at age 70. There used to be a day when it was only expected that you would live a few years into your social security years.

Social Security sets a full retirement age based on your. First congratulations on waiting until 70 to collect your Social Security benefits. 70 youll get 132 percent of the monthly benefit because you delayed getting benefits for 48 months.

If you took benefits after reaching full retirement. It is quite common for both men and women to live well into the 80s and beyond. Claiming Social Security at age 70.

But while Uncle Sam gives you a bonus for waiting to collect Social Security benefits he doesnt give you a dispensation from paying Social Security taxes. If you are able to delay claiming your Social Security benefit until you reach age 70 you will earn a significantly higher benefit.

/social-security-retirement-benefits-while-working-2894597-v1-1cd7c45096a24f059e87116a5c8e6326.png)