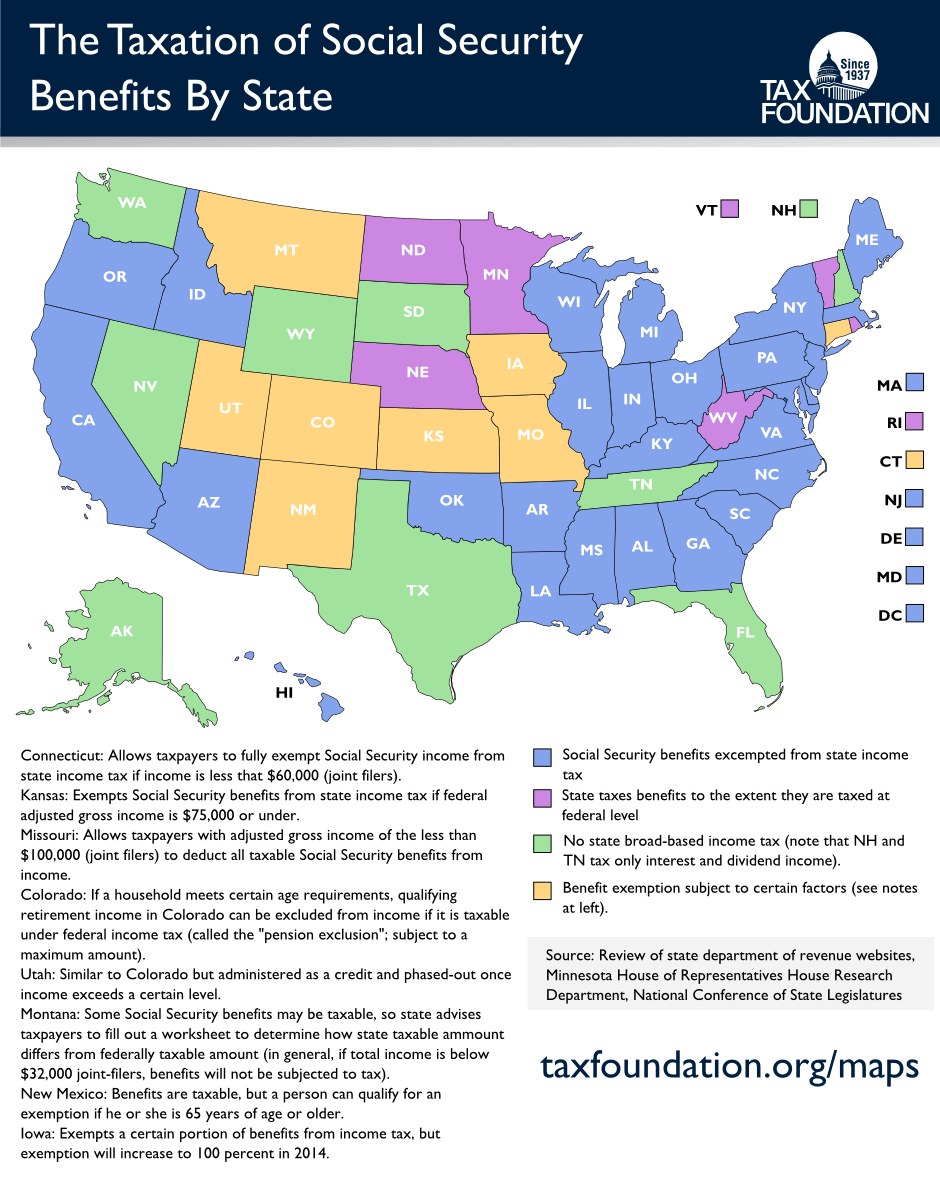

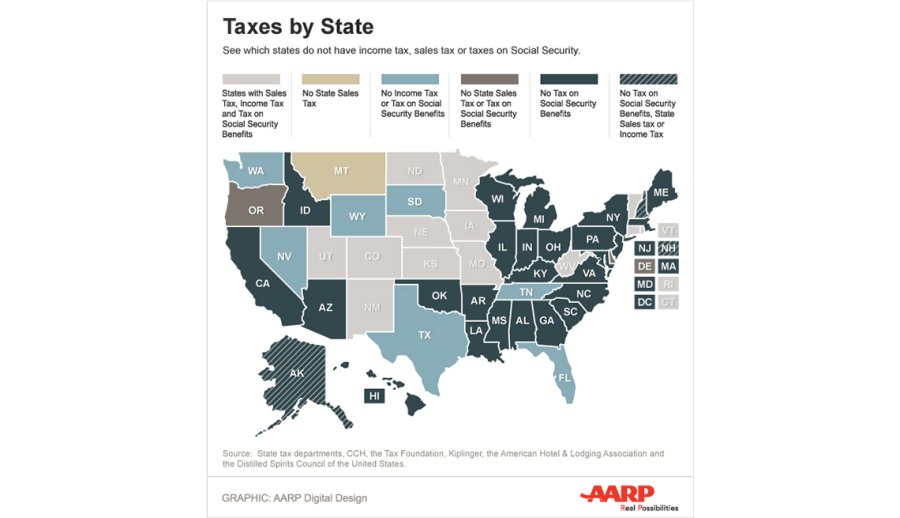

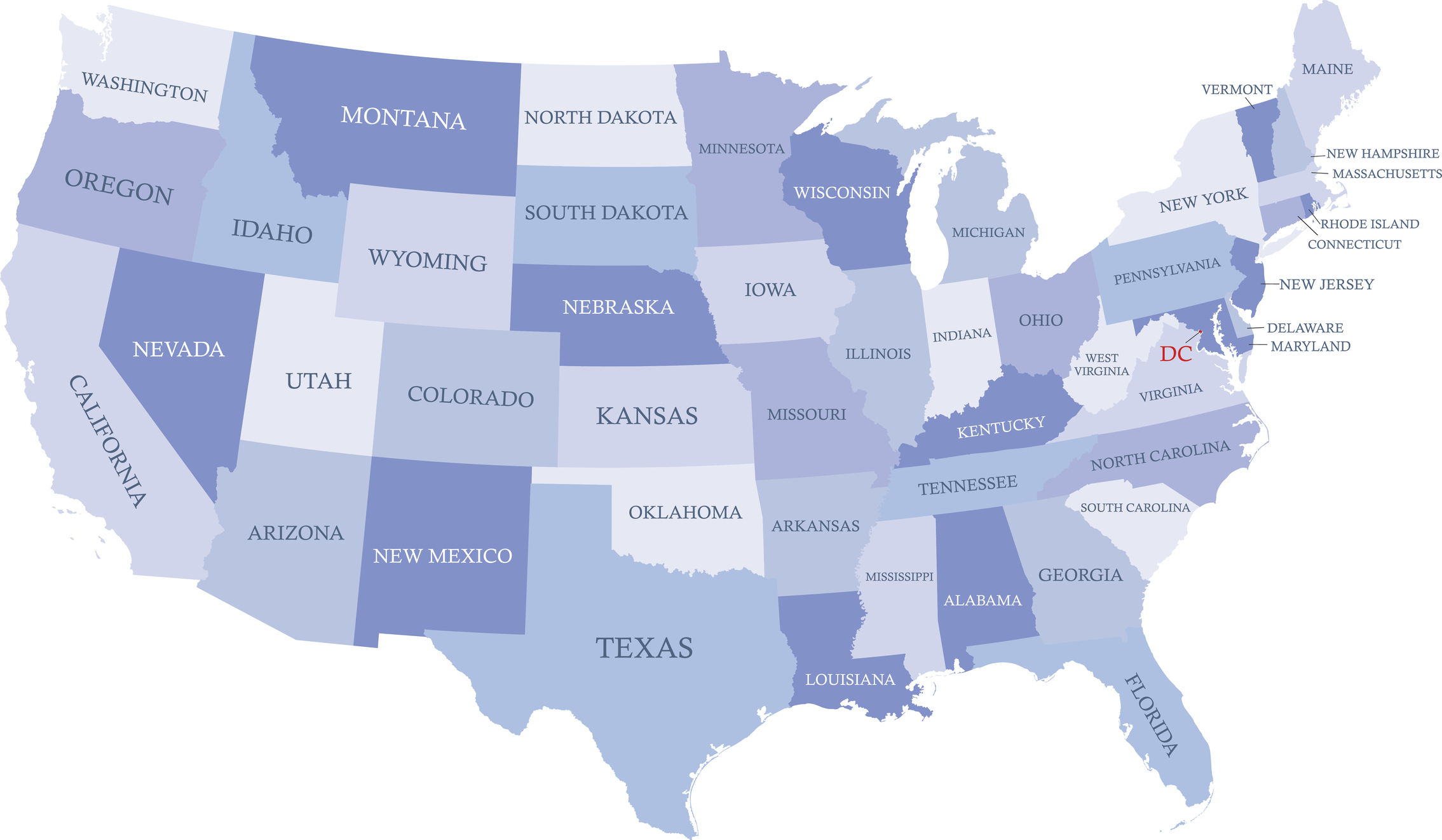

En español Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico North Dakota Rhode Island Utah Vermont and West Virginia collect state income tax on Social Security payments to at least some beneficiaries. Meanwhile Illinois Indiana Iowa Michigan Ohio and Wisconsin have full state income tax protection for those receiving Social Security benefits.

Citybizlist Washington Dc 37 States That Don T Tax Social Security Benefits

Citybizlist Washington Dc 37 States That Don T Tax Social Security Benefits

Either have no income tax AK FL NV SD TX WA WY or do not include Social Security benefits in their calculation for taxable income AL AZ AR CA DE DC GA HI ID IL IN IA KY LA ME MD MA MI MS NH NJ NY NC OH OK OR PA SC TN VA WI.

What states tax social security benefits. Social Security benefits fall into the category of income. Get Results from multiple Engines. They dont include supplemental security income payments which arent taxable.

In alphabetical order Alabama Alaska Arizona Arkansas California Colorado Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kentucky Louisiana Maine Maryland Massachusetts. Social Security benefits include monthly retirement survivor and disability benefits. Across the nation up to 85 of your benefits can be taxed by the federal government.

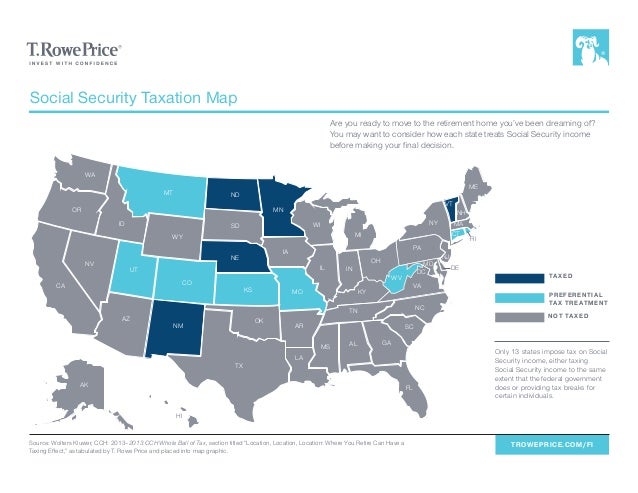

There are currently three states that tax Social Security benefits based upon the federal governments tiered tax system taxing up to 85 of a recipients total benefit based on total combined income. In other words double. Taxed According to Federal Rules.

Partially Taxed Exemptions for Income and Age Colorado Connecticut Kansas Missouri Montana Nebraska New Mexico Rhode Island Utah. Which states tax Social Security benefits. The other nine states that tax Social Security benefits do so in varied ways.

Ad Search For Relevant Info Results. State Taxes on Social Security Benefits. These states are Minnesota North Dakota and West Virginia.

For instance five years ago Minnesota North Dakota Vermont and West Virginia all had Social Security tax policies in place that mirrored the federal governments. Nevada has a 685 sales tax rate and localities add roughly an extra 15. The portion of benefits that are taxable depends on the taxpayers income and filing status.

There is no state income tax in Nevada and this includes there being no state income tax on Social Security benefits. Thirty-seven states and DC. Out in the Midwest only seven of 12 states are free of Social Security taxes.

Tax Tip 2020-76 June 25 2020 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Get Results from multiple Engines. Meanwhile these are the 13 states that do tax Social Security benefits.

There are seven states that dont have state income taxes and as a result dont collect taxes on Social Security benefits. Social Security benefits are also taxable. Minnesota North Dakota Vermont West Virginia.

Of the 50 states 13. If a state does not have income tax it automatically does not tax Social Security benefits. No State Tax on Social Security Benefits.

The 13 states currently imposing Social Security taxes include. In some states a state tax is also applied. Connecticut excludes Social Security benefits from income calculations for any taxpayer with less than 75000 single filers or 100000 filing jointly in adjusted gross income AGI.

Ad Search For Relevant Info Results. South Dakota doesnt have an income tax.

37 States That Don T Tax Social Security Benefits The Motley Fool

37 States That Don T Tax Social Security Benefits The Motley Fool

Do States Tax Social Security Benefits Optimal Social Security

Do States Tax Social Security Benefits Optimal Social Security

States That Tax Social Security Benefits Tax Foundation

States That Tax Social Security Benefits Tax Foundation

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

Monday Map State Income Taxes On Social Security Benefits Tax Foundation

Monday Map State Income Taxes On Social Security Benefits Tax Foundation

States That Don T Tax Social Security Benefits Financial Samurai

States That Don T Tax Social Security Benefits Financial Samurai

States That Offer The Biggest Tax Relief For Retirees

States That Offer The Biggest Tax Relief For Retirees

Which States Tax Social Security Benefits Fedsmith Com

Which States Tax Social Security Benefits Fedsmith Com

State By State Guide To Taxes On Retirees

State By State Guide To Taxes On Retirees

States That Don T Tax Social Security Military Benefits

States That Don T Tax Social Security Military Benefits

Finding A Tax Friendly State For Retirement Accounting Today

Finding A Tax Friendly State For Retirement Accounting Today

Social Security State Taxation Map

Social Security State Taxation Map

13 States That Tax Social Security Income The Motley Fool

13 States That Tax Social Security Income The Motley Fool

Deciding Where To Retire Finding A Tax Friendly State To Call Home La Opinion

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.