The SP 500 index is a stock index of 500 of the largest US. Where can you invest in the SP 500.

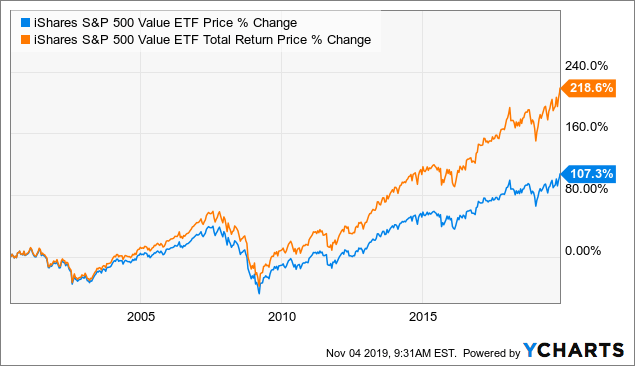

Ishares S P 500 Value Etf Now Is The Time To Invest Nysearca Ive Seeking Alpha

Ishares S P 500 Value Etf Now Is The Time To Invest Nysearca Ive Seeking Alpha

One thing I often hear out in the world is that in order to grow your money all you really need to do is just invest in an SP 500 Index fund.

Should i invest in s&p 500 now. According to data from Factset the SP 500s forward 12-month PE ratio is 219. If you invest 25000 that will save you 250 a. And the SP 500 dropped 382.

The most common way to invest in this index is through an index fund. Thus its a great idea to invest in the SP 500 as early as you can so that your returns compound upon one another. Should I Invest in a High Risk Index.

One of the most popular funds tracking. On average from 1980May 2019 the SP 500 has beaten the CRSP 1. Is SP 500 Overvalued.

SP 500 index funds are thus likely to eventually recover when the market takes a turn for the worse. A chart of the SP. Its a good deal if you take advantage of it and keep your emotions in check.

There have to be a ton of people out there who refer to themselves as index investors while only investing in the SP 500. That is a lot of money invested in 500 US. In addition SP 500 index funds are perfect for hands-off investors.

However keeping a diverse portfolio is crucial while the SP 500 will eventually always bounce back from any depression or recession its easier to weather those storms with a diverse collection of investments and assets. There are no minimum funding requirements to start investing in the SP 500. That is very different from just investing in an SP 500 Index fund or a variety of other asset class indexes that.

Thats why its a no-brainer to include the SP 500 as part of your portfolio Larger companies are generally more stable to invest in because. Knowing that you assume owning 500 different companies is well diversified plus youve read that the SP 500. SP 500 market index crashed in March 2020 and plunged by 34 from the level in Feb 2020.

From a valuation perspective stocks do seem to be pretty expensive right now. The SP 500 is once again nearing record highs prompting pause among investors worried about buying a top. When you invest in this.

Maybe thats because the investment has worked out really really well. This is a typically low cost mutual fund that invests in the stocks of 500 of the largest companies in the US in proportion to how their stock price performs. The extreme market rally has left many wondering if its now too late to get in the game of investing.

The vaccines news further skyrocketed the market and reached an all time high. However SP 500 have quickly rebounded and it is now trading at 75 higher than the level in Feb 2020. SP 500 investors endured 16 bear markets of 20 or more since 1929 says Sam Stovall market strategist at CFRA.

To be honest this is true for most other markets as well in fact all other markets I have tradedfollowed. Heres why you shouldnt worry. To put it another way use equities but dont abuse them by convincing yourself that over time the SP 500.

Investing in the SP 500 eliminates most of this risk due to the fact that there is not a Chinese company present in the index. Having said that an investor needs to invest an amount tha. To many the SP 500 is practically synonymous with index investing.

Then theres the Vanguard SP 500 ETF which charges just 003 making it 001 a year cheaper than the iShares Core SP 500 ETF at 004. After tinkering for countless hours over different types of allocations and fund combinations you decide simplicity is best for you and that on January 1st 2000 you will invest everything in a fund that tracks the SP 500 index. Use equities in your long-term portfolio but dont just do so in a skin-deep manner.