Low earners can typically. But Clarks person brand of frugality meant that he had a personal savings rate of 50.

Chart Save This Percentage Of Your Income Based On Your Years Until Retirement Clark Howard

Chart Save This Percentage Of Your Income Based On Your Years Until Retirement Clark Howard

Fidelity recommends saving 15 of your income to reach that 10 times your salary savings goal by the time youre 67.

What percentage of your income should you save for retirement. The short answer is that you should aim to save at least 15 percent of your income for retirement and start as soon as you can. We recommend that you save 15 of your annual salary for retirement. That percentage includes your employers match if you have one.

So if your employer puts in 5 youd need to. Most financial planners will tell you to save between 10 and 15 of your income for retirement. The short answer is that you should save a minimum of 20 percent of your income.

Thats a great starting point and theres plenty more to learn about how much you need to save for retirement. Thats why its best to automatically divert some money to your retirement account first before you can touch it. A well-researched rule of thumb is that a retirement income equal to 75 of your final salary just before you retire will allow you to live comfortably in retirement.

And those percentages can fluctuate within the course of a retirement. This figure accounts for the adjustments many people make as they age for example lower housing and higher medical costs. Thats why its best to automatically divert some money to your retirement account first before you can touch it.

The savings rate is much higher. If youre really ambitious they might advise you save 20 to 25 if you can swing it. You should crunch your numbers at least once a year to ensure you are keeping pace with the amount you.

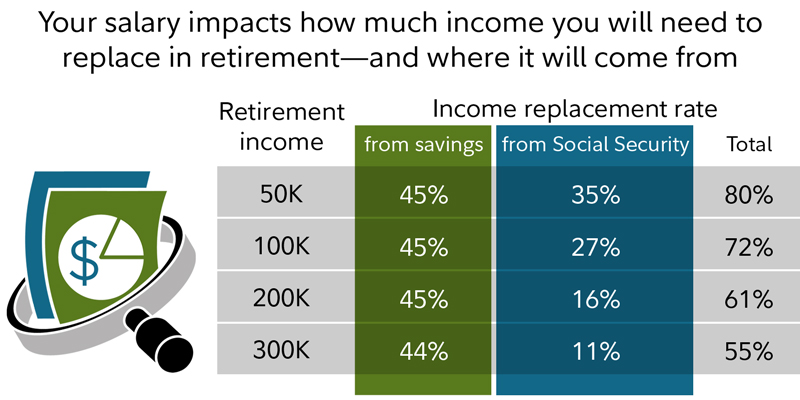

Conventional wisdom says that youll need to replace around 80 of your current income in retirement to maintain your same lifestyle during retirement. You should consider saving 10 - 15 of your income for retirement. High earners generally want to hit the top of that range.

It suggests savers should put 50 of their after-tax paychecks toward essentials like rent and food 30 toward discretionary spending and 20 toward savings. Research has shown that while some retirees need more than 80 percent of their previous income throughout retirement others can get by with closer to 50 percent. That 20 includes your employers match.

But theres more to the story. But that percentage might be too high or too low for many people saving for retirement according to a. This means that if you make 50000 a year before taxes you would need about 40000 a year in retirement to maintain your pre-retirement lifestyle.

At least 10 percent to 15 percent of that should go toward your retirement accounts. Fidelity recommends saving 15 of your income to reach that 10 times your salary. Thats a big part of what allowed him to retire in 1987 when he was 31.

According to CNNMoneys savings calculator you should save 13 percent of your annual income each year or 13000 if you want to retire at 65. Using a percentage of pre-retirement income method to estimate how much income you. Theres a lot of conflicting advice about what percentage of your income you should set aside for retirement.

One time-honored rule of thumb suggests that should save 10 of your income for retirement. As noted in the quote from Michael Finke above the percentage can range anywhere from 36 to 63 of gross income. Start saving at 25 and you only need to earmark 15 of your annual salary to retire at 65 and if you wait until 70 to retire youd only need to save 7 annually.

Beyond that most people should save about 20 of their total salaries each year for retirement. The other 5 to 10 percent of that should go toward a combination of building an emergency fund creating other. Some sources say 10 to 15 and others say 15 to 20.

As a rule of thumb most experts recommend an annual retirement savings goal of 10 to 15 of your pretax income.