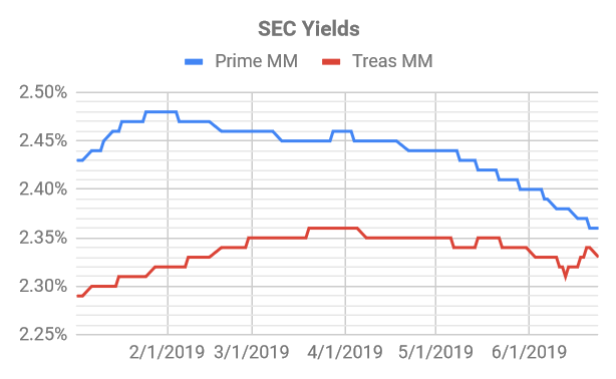

VMMXX is one of the money market mutual funds that saw its. The Vanguard Prime Money Market Fund change announced in late August drops the minimum for more than 1 million Prime fund investors from.

Why Is Vanguard Treasury Money Market Yield So High Bogleheads Org

Why Is Vanguard Treasury Money Market Yield So High Bogleheads Org

This security is currently yielding about 025.

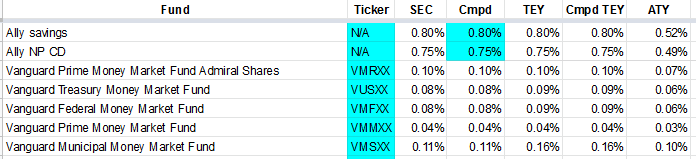

Vanguard money market interest rate. California Municipal Money Market 100 Massachusetts Tax-Exempt 100 New Jersey Long-Term Tax-Exempt 100 New Jersey Municipal Money Market 9725 275 New York Long-Term Tax-Exempt 100 New York Municipal Money Market 100 Ohio Long-Term Tax-Exempt 100 Pennsylvania Long-Term Tax-Exempt 100 Pennsylvania Municipal Money Market 100. Annual Percentage Yield APY 020. Annual Percentage Yield APY 015.

However Vanguard Brokerage requires a minimum of 10000 to open a CD followed by 1000 increments. To 8 pm Eastern time. As with all money market mutual funds the returns are dependent upon the current interest rate environment.

The current yield is 151 slightly lower than the Vanguard Prime Money Market fund. Ideal if youre looking for stability since the fund invests in short-term high-quality securities. This fund is for large investors with a.

You can also learn who should invest in this mutual fund. If youre already a Vanguard client. Minimum Balance to Earn APY.

Vanguard Ultra Short-Term Bond VUBFX 1008 is a collection of short-term bonds that can act as a higher-yielding alternative to money market funds while reducing interest rate risk in the. Since its inception in 1981 the fund has returned an average 413 per year despite a. Plus youll need at least 10000 to open a CD and the interest only compounds once it hits your money market account upon maturity.

Vanguard Prime Money Market Fund This is one of the most popular funds. Vanguard Federal Money Market Fund is the only settlement fund available. View mutual fund news mutual fund market and mutual fund interest rates.

This mutual fund profile of the Federal Money Mkt Fund provides details such as the fund objective average annual total returns after-tax returns initial minimum investment expense ratio style and manager information. Still its 5-Year CD carries a 045 interest rate that exceeds most CD rates youd get through banks directly. It requires a 3000 minimum deposit at a 016 expense rate with a 161 current yield.

Learn about Vanguard Federal Money Market. Vanguards CD rates arent competitive and to earn the highest rate youre looking at locking your money away for seven years. VMFXX A complete Vanguard Federal Money Market FundInvestor mutual fund overview by MarketWatch.

Investors who arent satisfied with this could choose a short-term bond fund like VBISX the Vanguard Short-Term Bond Index Fund. VMFXX Analysis - Vanguard Federal Money Market Fund - Bloomberg Markets. Vanguard Cash Sweep Interest Rates VMFXX does have a yield right now of 004.

So when interest rates rise money market mutual funds like Vanguards Prime Money Market Fund become much more attractive to investors. VMMXX A complete Vanguard Cash Reserves Federal Money Market FdInv mutual fund overview by MarketWatch. View mutual fund news mutual fund market and mutual fund interest rates.

Minimum Balance to Earn APY. Minimum Balance to Earn APY. Your money market settlement fund is used to pay for and receive proceeds from brokerage transactions including Vanguard ETFs in your Vanguard Brokerage Account.