The average stock market return for 10 years is 92 according to Goldman Sachs data for the past 140 years. A dividend yield can tell an investor a lot about a stock.

The Relationship Between The Yield Curve And The Stock Market Seeking Alpha

The Relationship Between The Yield Curve And The Stock Market Seeking Alpha

Ad Try Stockopedia for free to join our supportive community of private investors.

Stock market yield. JavaScript chart by amCharts 3204. Gain unique insights from our data-driven research team. The yield curve is generally indicative of future interest rates which indicates an economys expansion or contraction particularly inflation.

Oracle Corp 7829 191. Selling in the stock market leads to higher bond prices and lower yields as money moves into the bond market. Twitter Inc 7172 001.

However if the inflationary pressures begin to look up investors tend to move back to bond markets and dump equities. The SP 500 has done slightly better than that with. This chart shows the Yield Curve the difference between the 30 Year Treasury Bond and 3 Month Treasury Bill rates in relation to the SP 500.

Visa Inc 22636 004. Stock market rallies tend to raise yields as money moves from the relative safety of. The yield for the example would be.

20 2 100 022 or 22. Inflation expectation and bond yields. Inflation usually comes from strong economic growth.

Dividend Yield Market-cap weighted Dividend Yield for the Australian stock market. The bond yields will increase to offset the effect of inflation. Here are some high dividend yield stocks analysts love.

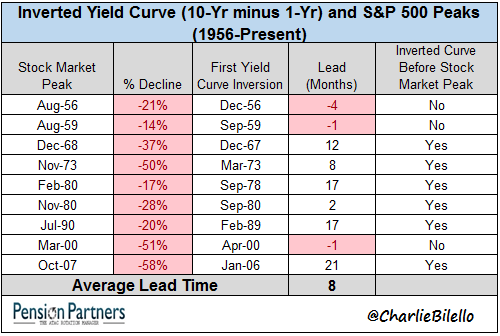

Chipotle Mexican Grill Inc 154098 -009. An investor can buy a stock and pocket a 3 yield on it over a year and see it drop in price by 10 to 20. The yield curve as a leading indicator of the stock market.

853 rows While there is no particular percentage that constitutes a stock as having a. Stocks change in value mostly from price movement and one can be happy with a stocks dividend yield but get very disappointed and lose quite a bit of money if the stock goes down in price a fair bit. Rising Treasury yields have contributed to a selloff by the stock markets pandemic high-fliers but probably wont be enough to spoil the appeal of stocks over bonds in 2021.

A rally in the stock market tends to raise yields as money moves from the relative safer investment bet to riskier equities. Gain unique insights from our data-driven research team. Yield Curve as a Stock Market Predictor NOTE.

The yield would be the appreciation in the share price plus any dividends paid divided by the original price of the stock. In our opinion the CrystalBull Macroeconomic Indicator is a much more accurate indicator than using the Yield Curve to time the stock market. In January 2020 the effective federal funds interest rate which is what banks charge each other to.

Ad Try Stockopedia for free to join our supportive community of private investors. Bank of America Corp 3876 005. It can determine an investments potential relative to the stock market or among a particular group of stocks trading in the same sector.

The global oil benchmark Brent crude was down more than 8 at 6231 per barrel in the afternoon while US oil fell nearly 8 to 5948 a barrel. Dividend Yield All Ords. So to provide advance warning for stocks the yield curve must be a longer leading indicator.

JavaScript chart by amCharts 3204. The yield curve is a leading indicator of the economy but the stock market is one as well.