Firstly the increase in benefits from delaying is not 8 for most years. After reaching FRA Social Security benefits increase 8 per year until you turn 70.

Delaying Social Security Retirement Benefits Simplywise

Delaying Social Security Retirement Benefits Simplywise

They can expect to live to 85 years old and the return on those delayed benefits is just under five percent a solid return for a conservative retirement portfolio.

Social security delayed benefits. One of the most commonly given reasons for delaying Social Security is that doing so provides you an 8 return But thats just not true. The month you attain age 70. How to make delaying work for you.

If you wait until you turn 70 you get all your credits right from the first payment. The rules for Social Security allow for a certain benefit at full retirement age which is then adjusted upwards or downwards by beginning early as early as age 62 or delaying until later as late as age 70. Delayed Retirement Credits Social Security retirement benefits are increased by a certain percentage for each month you delay starting your benefits beyond full retirement age.

Callers claiming to be the Social Security Administration SSA are targeting SS benefit recipients. For example if she claims at 67 she would get 2318 which. To figure out how long it takes for you to break even by delaying Social Security benefits calculate how much money youd receive over the years if.

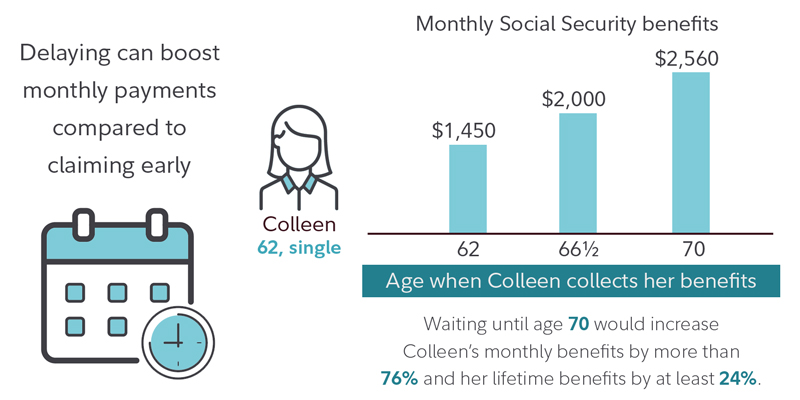

The credits stop accruing when you reach 70. Delaying your Social Security start date until age 70 entitles you to a monthly payout thats more than 75 percent higher than your age-62 benefit. The benefit increase stops when you reach age 70.

If the beneficiary delays past 66 she also gets a delayed retirement credit of 8 which is applied to the COLA-adjusted benefit. Currently the benefit of delaying Social Security until age 70 is one of the most quantifiable aspects of retirement planning. Yes you can pick up an increase in benefits for delaying.

67 youll get 108 percent of the monthly. They are then asking the victims to verify their social security information. Theres simply no way to beat that return invested in the market on a risk-adjusted basis.

In January of the year following the year you earned the delayed retirement credits. In the Social Security Administrations operations manual you can see there are two times retirement benefits are increased for delayed retirement credits. Lets look a specific example to better understand this.

51 rows If you start receiving retirement benefits at age. If your parents and grandparents all make it to a ripe old age you exercise and eat right then you might consider delaying social security paymentsmaybe even to 70. Delaying Social Security retirement benefits until 70 might work for Karen but that doesnt mean its the right path for everyone.

Increase for Delayed Retirement. By delaying from 62 to 70 you get about 76-77 more per month than you would get if you started your benefit at age 62. One of the most important considerations to deciding whether to claim benefits early on time or delayed is the state of your health and what you believe your life expectancy to be.

If you delay from age 62 to 70 that translates into average annual benefits increase of 74 per year. Thats a whole lot more money to support a much older you. If you file for Social Security after FRA but before age 70 your delayed retirement credits are added to your benefit payment starting in January of the year after you earned them.

Adjusting Benefits Based On Social Security Timing BeforeAfter Full Retirement Age. They are advising them their checks will be delayed due to the power outages and damage in the storms wake.