Best Sources of Retirement Income. Many bonds provide a relatively predictable stream of retirement income with limited potential for losses.

Ensuring A Comfortable Nest Egg

Ensuring A Comfortable Nest Egg

Instead you will use your retirement income plan to calculate how much you will need to withdraw from your financial accounts.

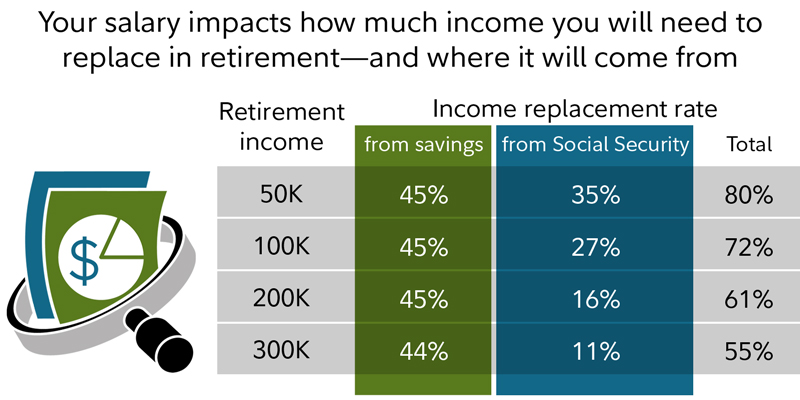

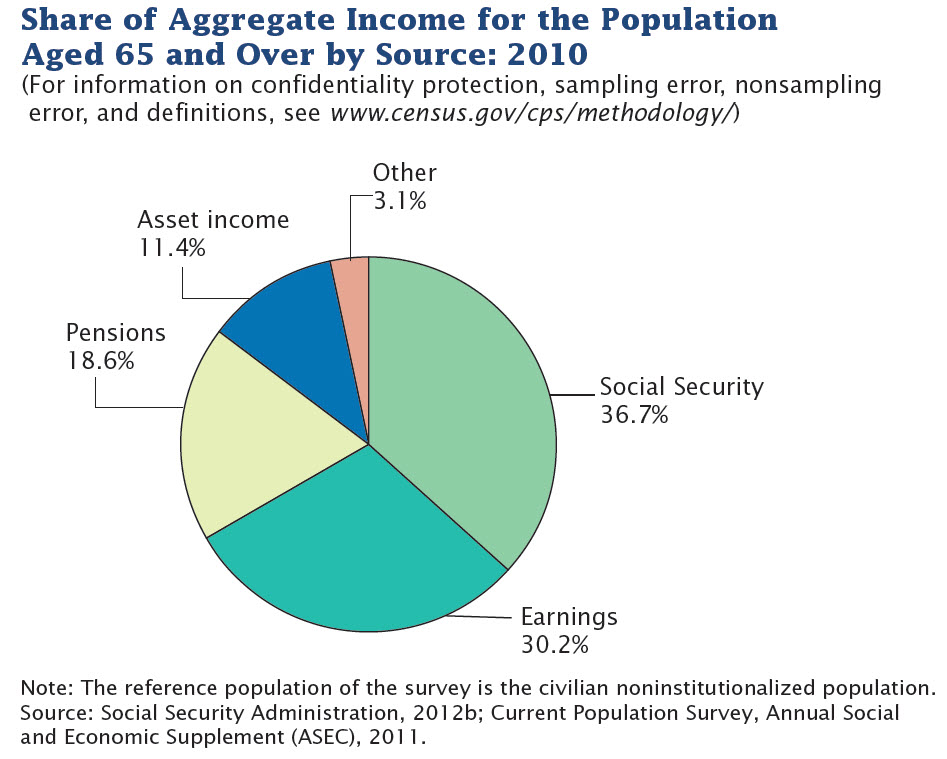

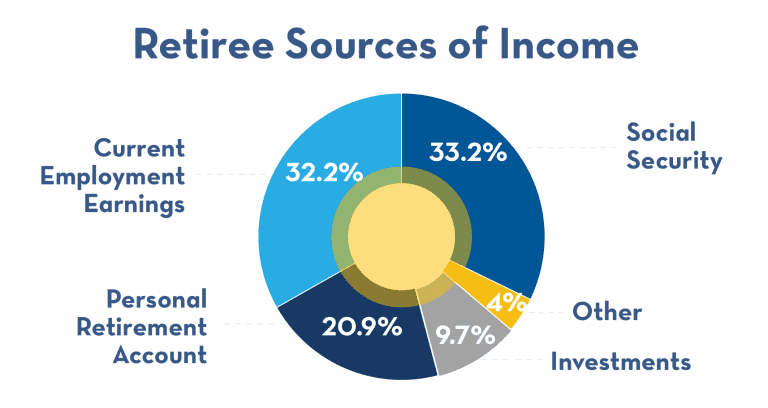

Retirement income sources. Input expected lump sums such as life insurance proceeds an inheritance or net proceeds from the sale of a piece of property. As pensions continue to recede from the workplace Social Security is the only guaranteed source of retirement income that a lot of Americans can. Of that 38 depend on Social Security for the majority of their retirement income.

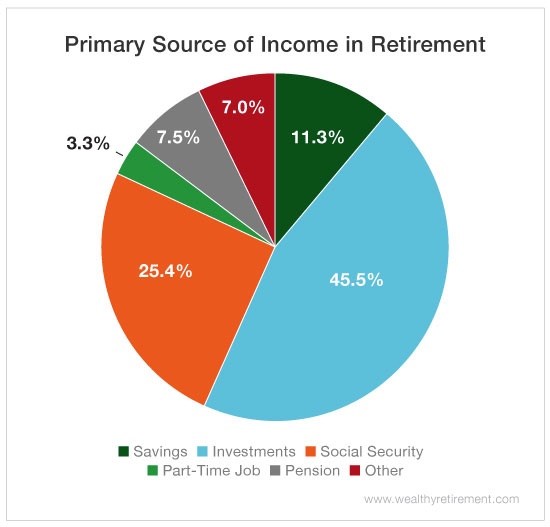

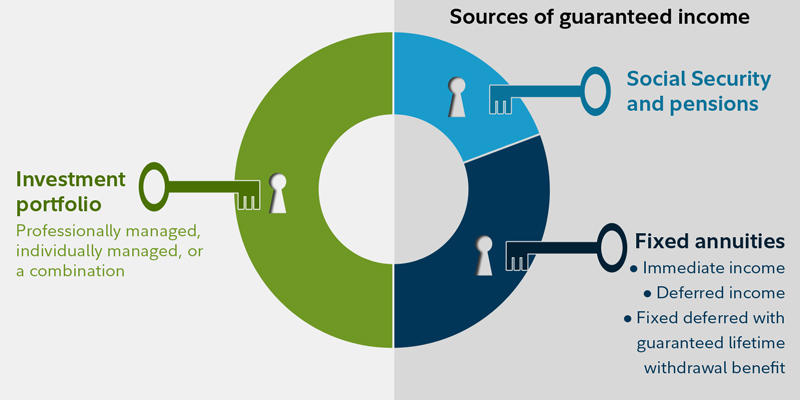

Retirement income is often referred to as a three-legged stool including Social Security pensions and savings. According to a recent Gallup survey of 1020 Americans 54 percent of retirees say Social Security is a major source of. Do not input investment income sources such as dividends interest or capital gains.

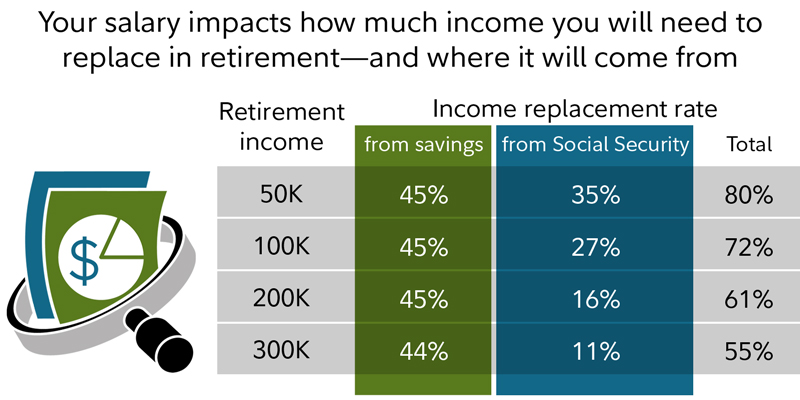

By Justin Pritchard CFP As you plan for retirement you need to know what resources you have available. This amount plus any income from other sources will be deducted from annual income required to calculate the amount of income retirement your savings will have to generate. According to the Social Security Administration SSA more than 85 of people 65 and older receive Social Security benefits.

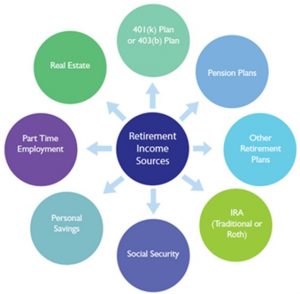

Your assets and future income sources will create your retirement income so it makes sense to take inventory periodically. Investing for Retirement The ways to save for retirement are varied each with their own set of benefits for retirees. Other annual income if you expect income from other sources besides your retirement saving and government social security or pensions enter the annual amount.

Here are the 10 biggest sources of retirement income. Doing so helps you know where you stand and avoid surprises when Retirement Day comes plus you need to continue to monitor assets during retirement. Picking the right ones for your life and income can have huge impacts on when you can retire what kind of lifestyle you can enjoy and when youll need to pay taxes on the money you put away.

But it turns out that one income source Social Security is the dominant and. Your income in retirement will come from three sources. Some types of bonds such as Treasury Inflation-Protected Securities promise a rate of.

For example if you expect a pension from an employer enter.

Potential Sources Of Retirement Income

Top Primary Sources Of Retirement Income

Top Primary Sources Of Retirement Income

The Five Risks Of Retirement Legacy Financial Advisors Llc

Retirement Income Sources Pre And Post Retirement Retirement Income

Retirement Income Sources Pre And Post Retirement Retirement Income

Retirement Income Coming Up With A Plan Fidelity

Retirement Income Coming Up With A Plan Fidelity

How Much Money Do You Need To Retire Equitable

How Much Money Do You Need To Retire Equitable

Check Yourself Do You Know How Your Retirement Income Will Be Taxed

Check Yourself Do You Know How Your Retirement Income Will Be Taxed

7 Streams Of Income Wish To Retire

7 Streams Of Income Wish To Retire

Got 7 Sources Of Income Retirement Age How To Become Income

Got 7 Sources Of Income Retirement Age How To Become Income

Retirement Income Steps To Financial Freedom Pure Financial Advisors Inc

Retirement Income Steps To Financial Freedom Pure Financial Advisors Inc

What Will My Savings Cover In Retirement Fidelity

What Will My Savings Cover In Retirement Fidelity

Sources Of Retirement Income Filling The Social Security Gap Military Benefit Association

Sources Of Retirement Income Filling The Social Security Gap Military Benefit Association

How Should Retirees Approach The Decumulation Phase Of Their Retirement Savings Pentegra Retirement Services

How Should Retirees Approach The Decumulation Phase Of Their Retirement Savings Pentegra Retirement Services

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.