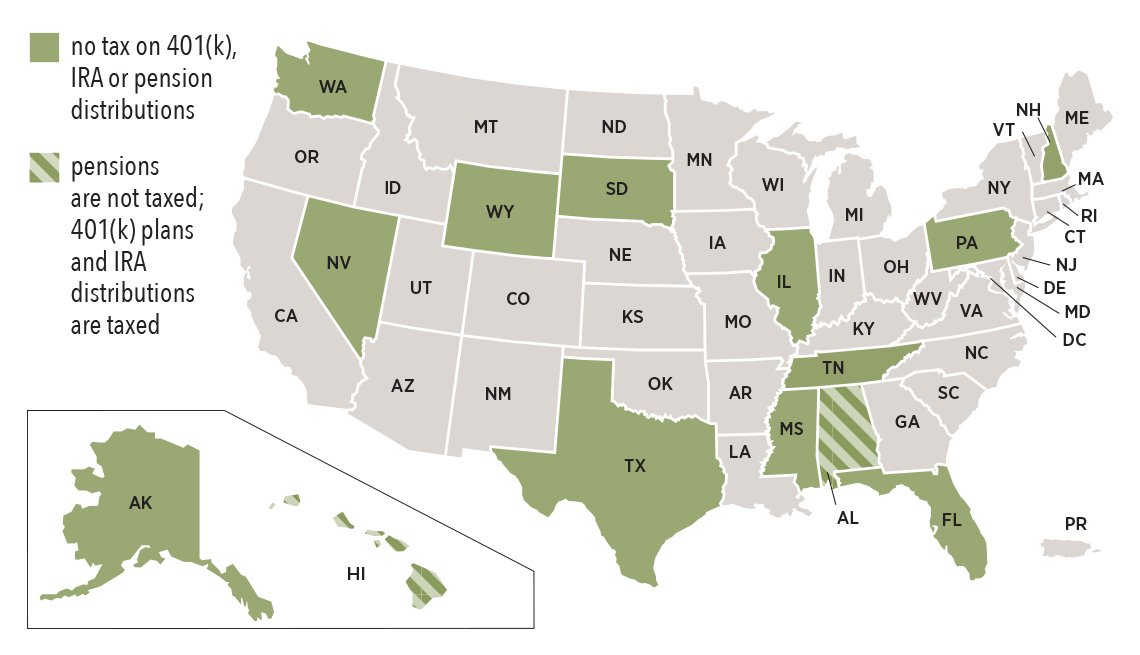

Nine of those states that dont tax retirement plan income simply have no state income taxes at all. The most tax-friendly states for retirees Seven of the best states for retirees tax-wise are.

Tax Friendly States For Retirees Best Places To Pay The Least

Tax Friendly States For Retirees Best Places To Pay The Least

Alaska Florida Nevada South Dakota Texas Washington and Wyoming.

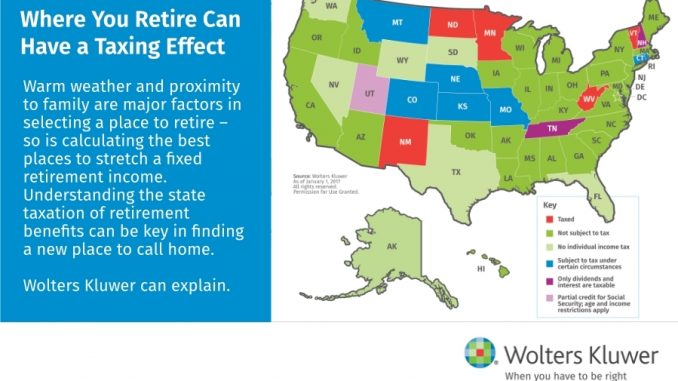

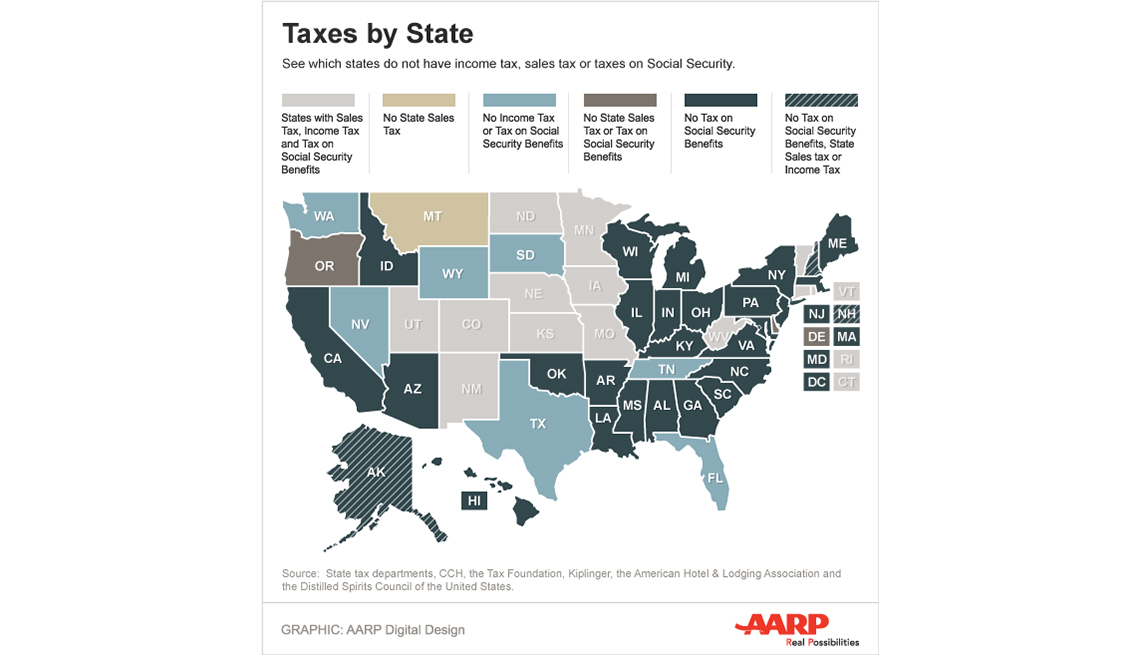

Tax free states to retire. The remaining three Illinois Mississippi and Pennsylvania dont tax distributions from 401 k plans IRAs or pensions. That is because other tax free states make up for the tax shortfall with particularly high property taxes sales taxes or other taxes. For those of us who want to retire in the US there are nine states that have no state income taxes.

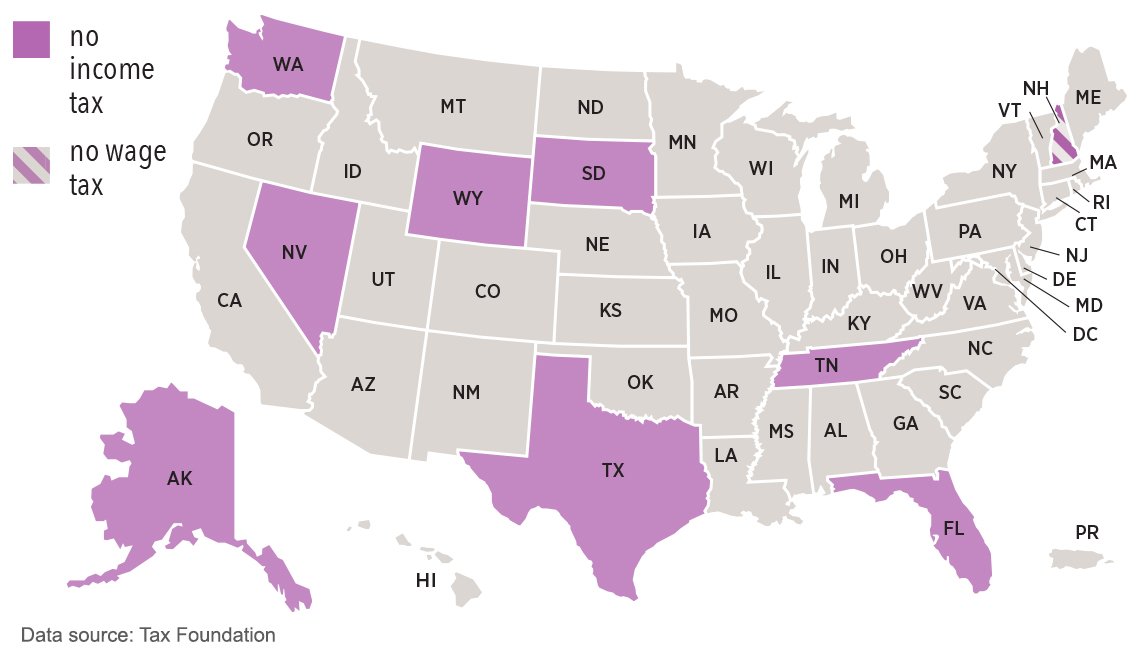

Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. Its important to note that states that dont tax personal income will typically replace any lost revenue with other taxes or. Retirees dont need to pay a state tax on Social Security benefits pension payments retirement account withdrawals or income.

Alaska Florida Nevada South Dakota Texas Washington and Wyoming dont have state income tax but retirees also need to consider taxes on sales Social Security retirement distributions. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. The reason New Hampshire is not higher on our list is that it has the third highest property tax rates in the country.

Alaska Florida Nevada South Dakota Texas Washington and Wyoming. In Georgia Social Security retirement benefits are not taxed and the state provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older. And for retired veterans all military retirement pay is tax-exempt in 20 states across the nation.

Washington is one of the states with the lowest taxes for retirees because it has no state income tax or a tax on Social Security. South Dakota is another state that doesnt have an income tax. New Hampshire is a good state for retirees because residents dont pay state income taxes state and local sales taxes and they dont pay estate or inheritance taxes.

There are seven states with no income tax on wages earnings or investment income. Plus the property tax rate is lower than in half of the states. However Alaska Florida Nevada South Dakota Texas Washington and Wyoming are also state income tax free.

Georgia also has no inheritance or estate tax. Wyoming is the only tax free state no state income tax to make the list of the lowest tax states for retirees. But moving to a state with no income tax could leave you with more money to cover other costs in retirement.

There are 11 states with no income tax for retirees.

37 States That Don T Tax Social Security Benefits The Motley Fool

37 States That Don T Tax Social Security Benefits The Motley Fool

9 States That Don T Have An Income Tax

9 States That Don T Have An Income Tax

Best And Worst States For Retirement Retirement Living

Best And Worst States For Retirement Retirement Living

Which States Are Best For Retirement Financial Samurai

Which States Are Best For Retirement Financial Samurai

9 States That Don T Have An Income Tax

9 States That Don T Have An Income Tax

Tax Friendly States For Retirees Best Places To Pay The Least

Tax Friendly States For Retirees Best Places To Pay The Least

Best States To Retired In With The Lowest Cost Of Living Finance 101

Best States To Retired In With The Lowest Cost Of Living Finance 101

Income Tax Free States May Be Worth Considering For Residency In Retirement Insight Law

Income Tax Free States May Be Worth Considering For Residency In Retirement Insight Law

The Most Tax Friendly States To Retire Usa Daily Chronicles

The Most Tax Friendly States To Retire Usa Daily Chronicles

States That Offer The Biggest Tax Relief For Retirees

States That Offer The Biggest Tax Relief For Retirees

States That Won T Tax Your Military Retirement Pay

States That Won T Tax Your Military Retirement Pay

States That Won T Tax Your Retirement Distributions

States That Won T Tax Your Retirement Distributions

State By State Guide To Taxes On Middle Class Families

State By State Guide To Taxes On Middle Class Families

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.