These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more. Assessment Taxation Department.

What Can You Do When Your Property Taxes Are Too High Tax My Property Fairly

What Can You Do When Your Property Taxes Are Too High Tax My Property Fairly

Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only available with a Freedom of Information Act FOIA request.

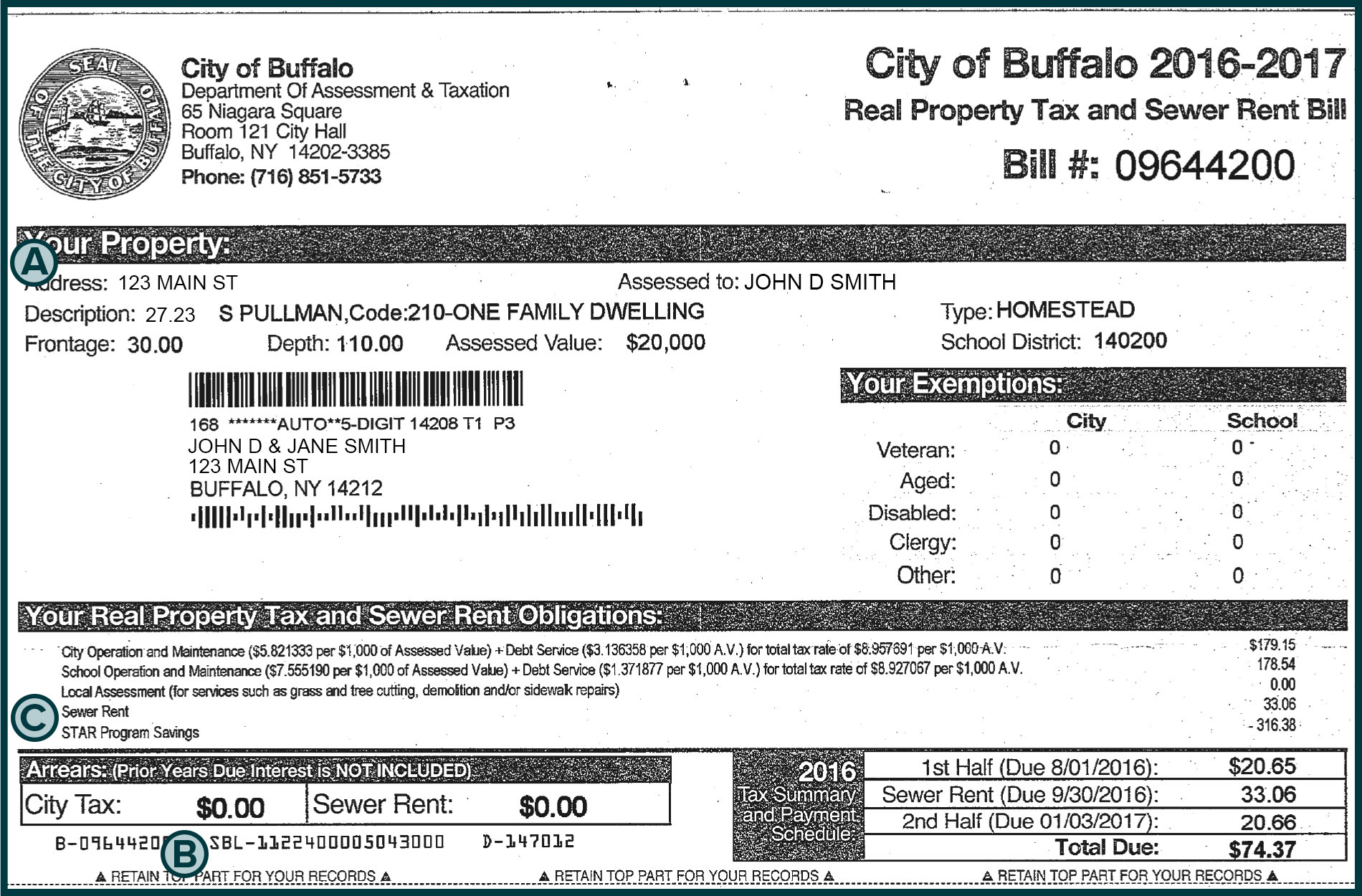

Property taxes buffalo ny. The following pages help you find your parcel view your bills select the installments and make payments. Property Tax Sewer Payments. You may also mail your payment or make a payment at Room 114 in City Hall.

Pay you Occupancy bill here. Find Tax Records including. The 2020 Assessment Preliminary Disclosure Notices include assessments based on current market values to ensure that every property owner is paying only their fair share of property taxes.

City User Fee Payments. The median property tax in New York is 375500 per year for a home worth the median value of 30600000. There are currently 243 red-hot tax lien listings in Buffalo NY.

Although we were originally conceived as a Big 4 National Property Tax Services Group Paradigm Tax Group is now an independent property tax consulting firm with a national reach making it possible for us to not only focus on New York State real property taxes and Connecticut real and personal property tax services but also on other regional property tax services throughout the United States. Pay you City Property Tax and Sewer Rent Bills for current and arrears. Access the ePermits website.

Street Address Please Do Not Include Street Suffixes rd st ave. If paying after the listed due date additional amounts will be owed and billed. 2834 The property tax rate shown here is the rate per 1000 of home value.

Residents and business owners will soon be receiving the disclosure notices in the mail. 2021 Final Assessment Roll. Erie County Real Property Tax Services Edward A Rath County Office Building 95 Franklin Street - Room 100.

Erie County Real Property Tax Services Edward A Rath County Office Building 95 Franklin Street - Room 100 Buffalo New York 14202. You will need your Parcel ID or Address to search and pay for your property taxes online. Click here to pay your parking tickets online.

City TaxSewer Rent Payments. Buffalo Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Buffalo New York. Pay Your Property Taxes and User Fee.

Erie County Real Property Tax Services Edward A Rath County Office Building 95 Franklin Street - Room 100 Buffalo New York 14202. Pursuant to the New York State Real Property Tax Law The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable assessed valuation of all property within the City of Buffalo. The reassessment project on all real property in the City of Buffalo is complete.

Enjoy the pride of homeownership for less than it costs to rent before its too late. If the tax rate is 1400 and the home value is 250000 the property tax would be 1400 x 2500001000 or 3500. New York has one of the highest average property tax rates in the country with only three states levying higher property taxes.

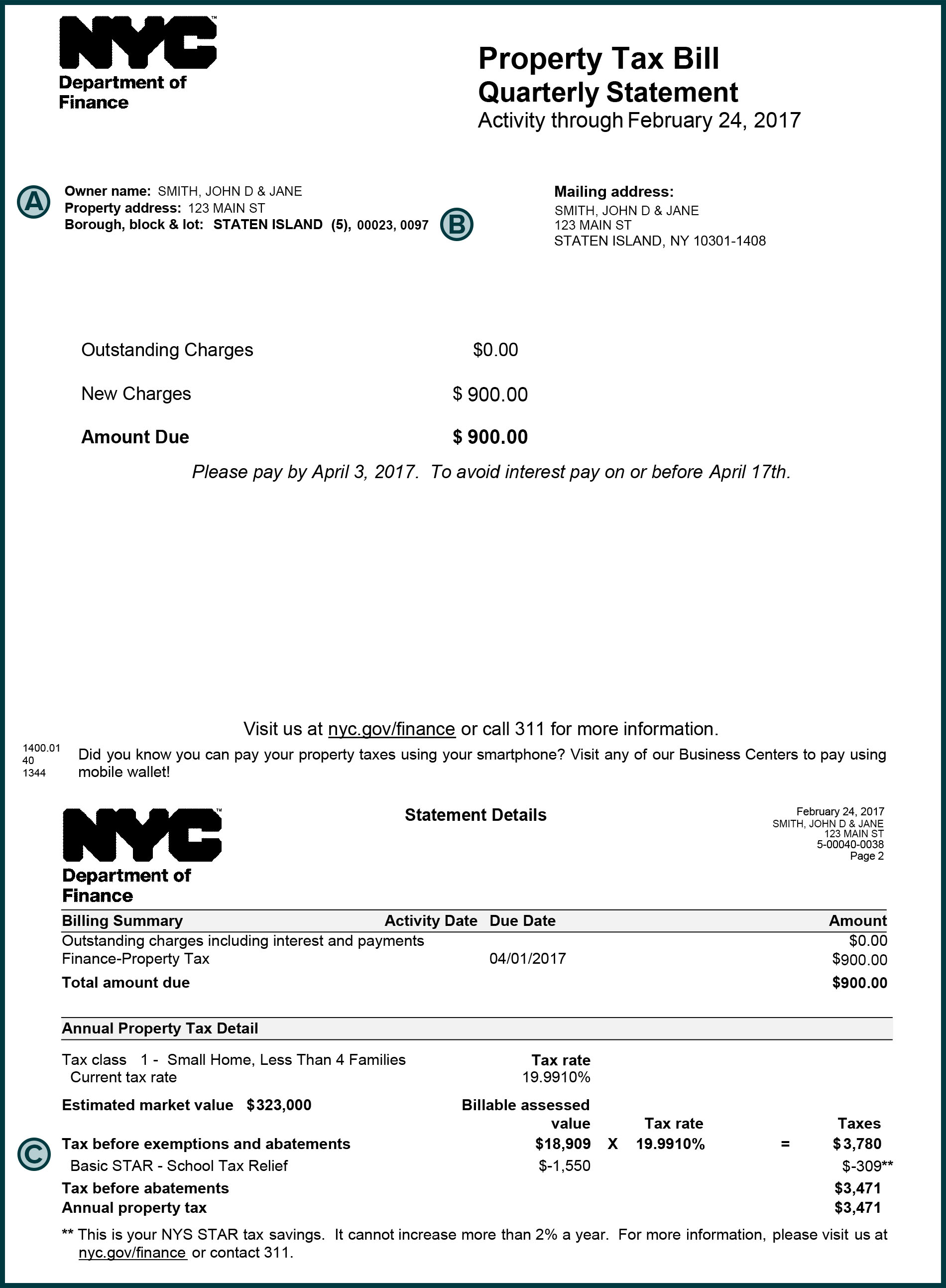

The city has four classes of property. That means that homeowners pay far lower property taxes in New York City than other types of property owners. Pay for User Fee bills here.

The Department issues the appropriate annual tax bill predicated on the final assessed value. Counties in New York collect an average of 123 of a propertys assesed fair market value as property tax per year. Residential one-family and three-family homes are class one The assessment ratio for class one property is 6.

Tax Records include property tax assessments property appraisals and income tax records. View and pay for your property tax billsstatements in the City of Buffalo NY online using this service. The ratio for other classes of property commercial and apartment buildings is 45.

Tax Maps Real Property Tax Services

Tax Maps Real Property Tax Services

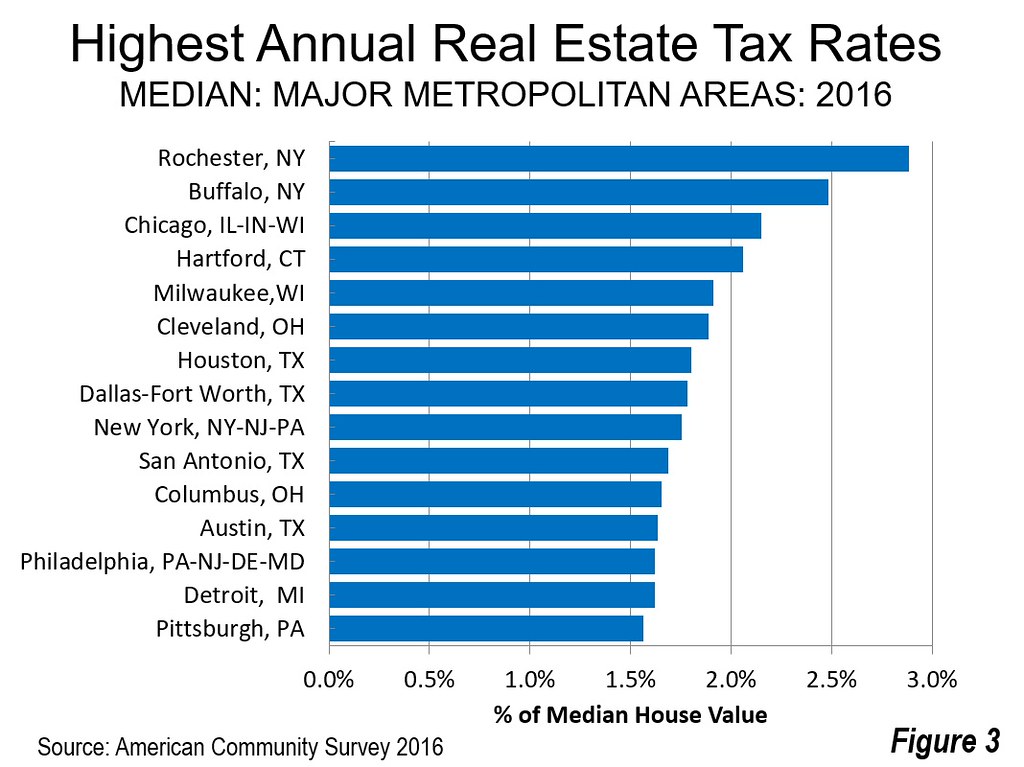

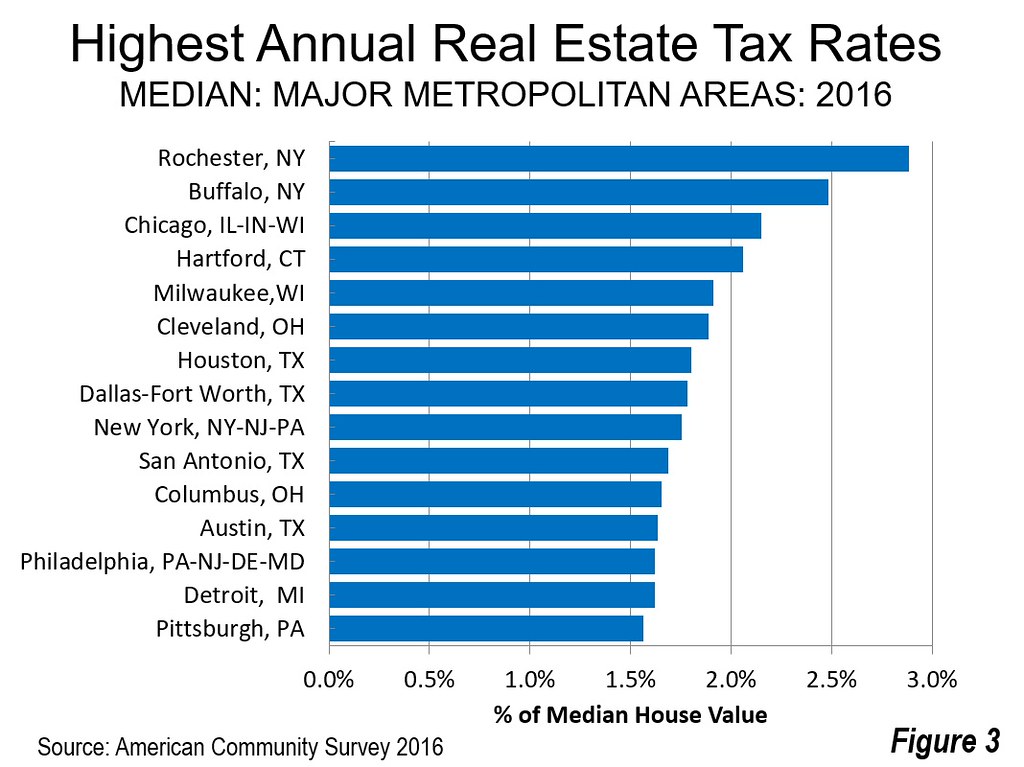

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Buffalo Ny Cost Of Living Guide 2020 Is Buffalo Affordable Wayfinder Moving Services

Buffalo Ny Cost Of Living Guide 2020 Is Buffalo Affordable Wayfinder Moving Services

Why Your County Tax Bill Is Going Up When Erie County Says It S Going Down Local News Buffalonews Com

Why Your County Tax Bill Is Going Up When Erie County Says It S Going Down Local News Buffalonews Com

Exemptions For The City Of Buffalo Only Buffalo Ny

3 Best Tax Services In Buffalo Ny Expert Recommendations

3 Best Tax Services In Buffalo Ny Expert Recommendations

Town Hall Meeting City Of Buffalo Comprehensive Property Tax Reassessment Buffalo Rising

Town Hall Meeting City Of Buffalo Comprehensive Property Tax Reassessment Buffalo Rising

Is The City Increasing Your Property Taxes Wolfgang Weinmann Buffalo Ny

Is The City Increasing Your Property Taxes Wolfgang Weinmann Buffalo Ny

Tax Maps Real Property Tax Services

Tax Maps Real Property Tax Services

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.