The Tax Cuts and Jobs Act capped it at 10000 per year consisting of property taxes plus state income or sales taxes but not both. It stands for the State and Local Tax Deduction and it can reduce your tax bill.

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

System of fiscal federalism.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

What is the salt deduction. What is the SALT deduction and how has it changed. The SALT deduction is one tool for redistributing tax revenue but most working people dont have access to it because they dont itemize their tax deductions to be able to qualify for it. The SALT deduction allows you to deduct up to 10000 of your state and local property taxes in addition to state income or state sales tax not both.

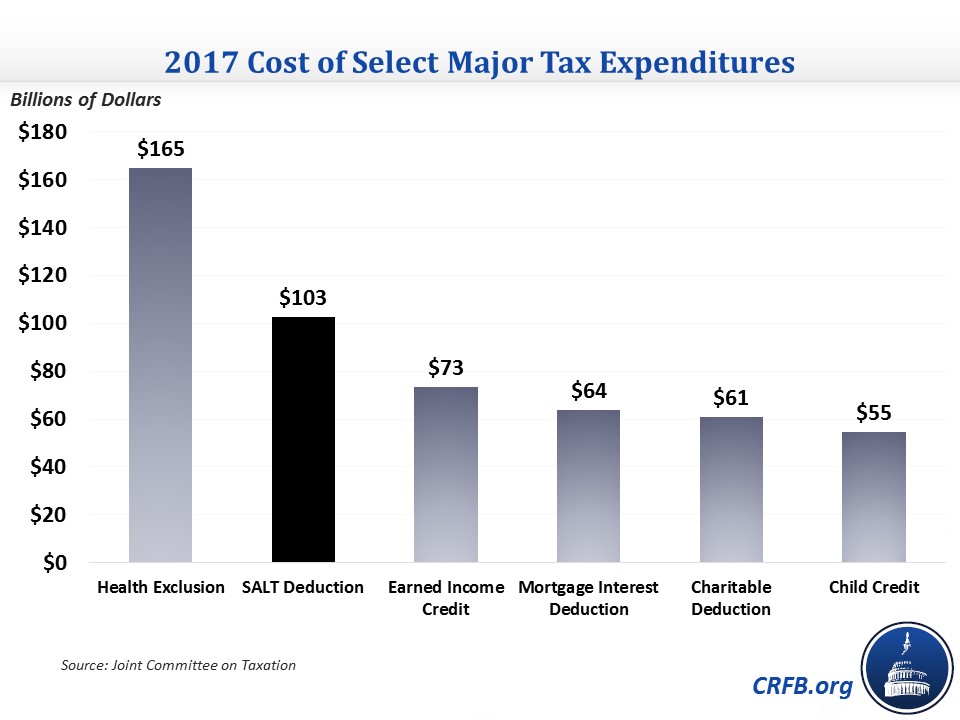

Answer The federal tax reform law passed on Dec. Back in the old days the state and local tax SALT deduction was arguably the most popular tax deduction in America. The deduction is fundamental to the way states and localities budget for and provide critical public services and a cornerstone of the US.

The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately. For starters the combined SALT and mortgage interest deductions create a strong incentive for homeownership. Prior to the 2018 Tax Cuts and Jobs Act the SALT deduction -- short for state and local tax deduction --.

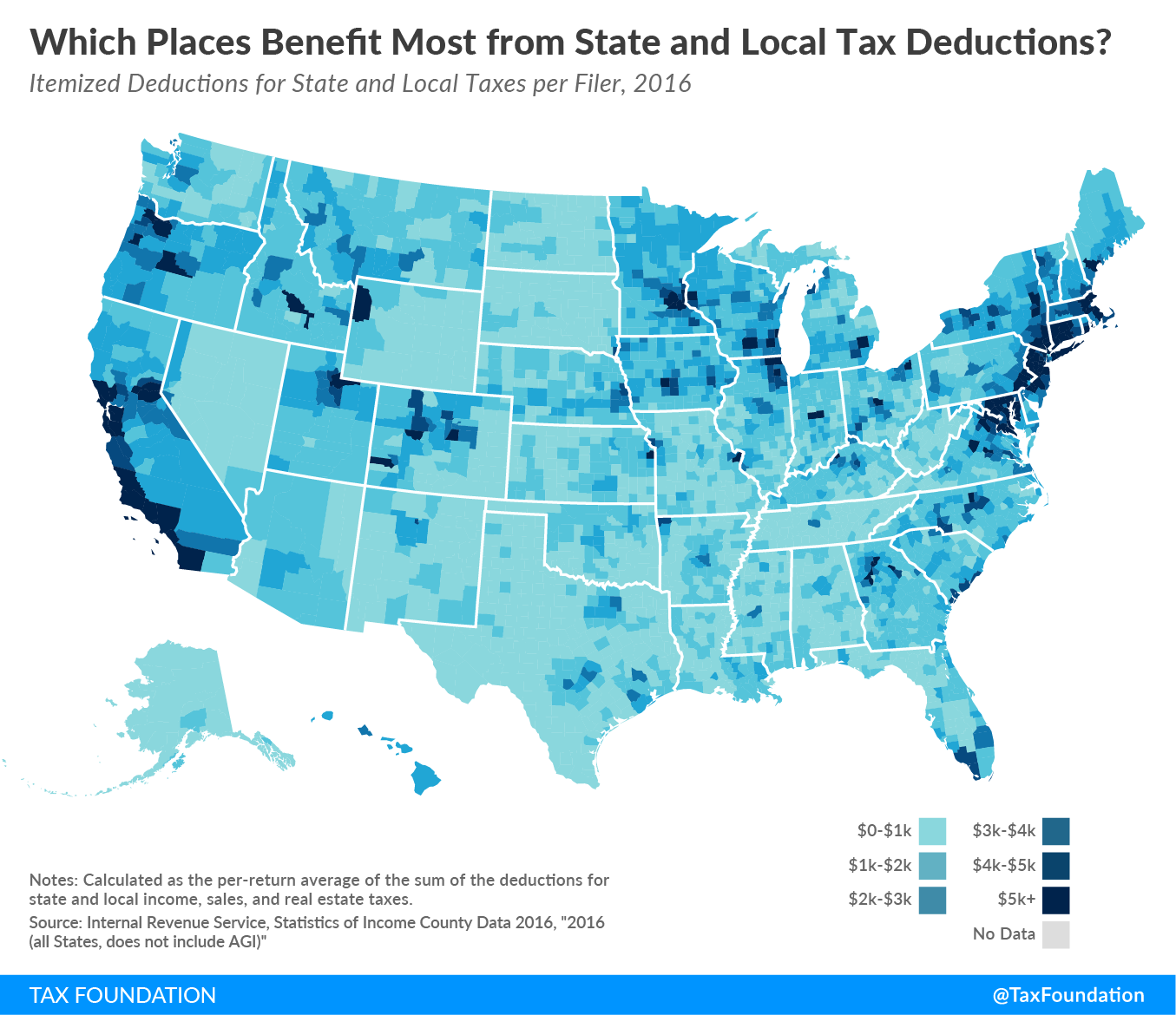

53 rows The value of the SALT deduction as a percentage of adjusted gross income AGI increases with a taxpayers income. Starting with the 2018 tax year the maximum SALT deduction available was 10000. Taxpayers who itemize their taxes can deduct state and local property and real estate taxes and either state and local income or sales taxes.

Call the SALT deduction a tax cut for people with secure jobs and excellent health insurance working from expensive homes Theyd like to see it eliminated altogether. If you claim the standard deduction you cant take the SALT deduction. What is the state and local tax deduction.

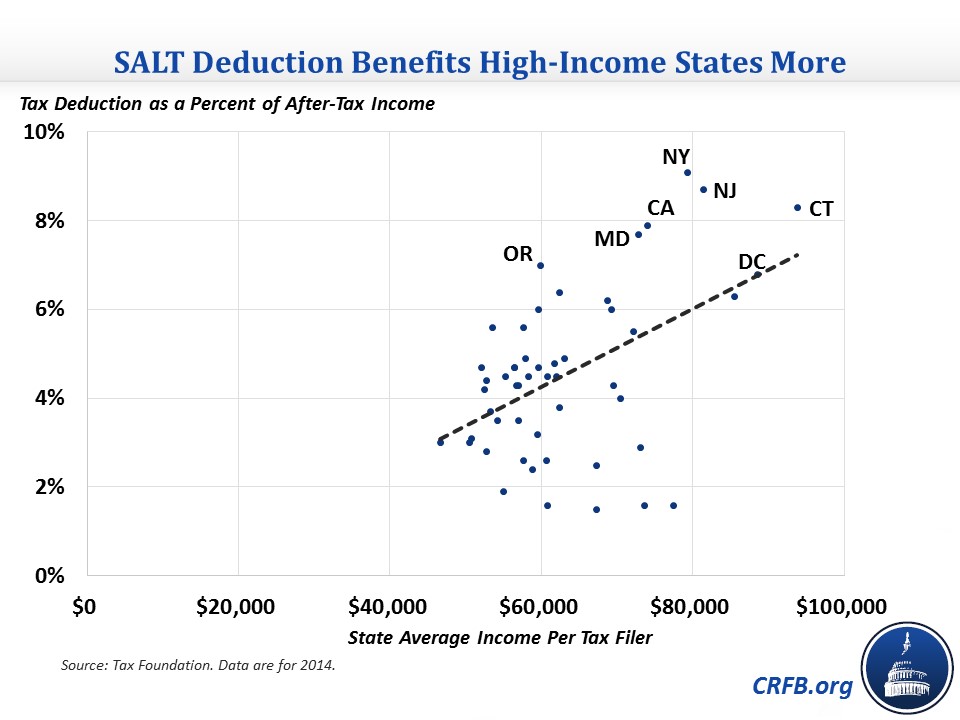

While its true that many middle-class households claim the SALT deduction its the wealthy who get the lions share of the savings. But for those who itemize deductions well walk. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

According to the Tax Foundation nearly 90 percent of the value. For the taxpayer who itemizes the benefits go beyond just mere deductions. 52 rows The state and local tax deduction commonly called the SALT deduction is.

The Trump tax cut of 2017 slashed the SALT deduction to 10000 from an unlimited amount. What is the SALT Deduction. Your standard deduction is a fixed amount that you can deduct that is based on your filing status you get an additional amount added to your standard deduction if you are 65 or older.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. Some Democrats want to get rid of the cap as itemized deductions can be. The SALT deduction reflects a partnership between the federal government and state and local governments.

But not everyone can claim the SALT deduction. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. What is the State and Local Tax SALT Deduction.

You probably remember your parents or grandparents saving every receipteven on small purchases like a box of nails or a single heirloom tomatoand stuffing them in a. The SALT deduction provides key benefits. The combination you choose to deduct will depend on your specific circumstances and what benefits you most.

The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. In 2016 taxpayers with AGIs between 0 and 24999 claimed in aggregate SALT deductions worth only 23 percent of AGI whereas taxpayers with incomes of 500000 or higher claimed deductions worth 77 percent of AGI. And the sales-tax deduction provides additional incentives to encourage consumer spending which helps economic growth.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png) Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Salt Cap Repeal Salt Deduction And Who Benefits From It

Salt Cap Repeal Salt Deduction And Who Benefits From It

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Salt Cap Workarounds Will They Work Accounting Today

Salt Cap Workarounds Will They Work Accounting Today

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png) The State And Local Tax Deduction Explained Vox

The State And Local Tax Deduction Explained Vox

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png) The State And Local Tax Deduction Explained Vox

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Congress And The Salt Deduction The Cpa Journal

Congress And The Salt Deduction The Cpa Journal

The Price We Pay For Capping The Salt Deduction Tax Policy Center

The Price We Pay For Capping The Salt Deduction Tax Policy Center

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.