Ad Get a Card with 0 APR Until 2022. This is because of your credit to debt ratio.

/difference-between-a-credit-card-and-a-debit-card-2385972-Final-5c4731cbc9e77c00018a49e9.png) The Difference Between Credit Card And A Debit Card

The Difference Between Credit Card And A Debit Card

Forget what youve heard.

How much of credit card to use. Your credit utilization ratio the amount of credit you use compared with your credit limit is an important measure of this. So your credit utilization is 3000 divided by 6000 or 50. Use much less than 30 of your available credit card limit.

Under the Fair Credit Billing Act your liability for unauthorized card use is limited to 50. You carry no balance on your third card. Your credit utilization rate also referred to as your debt-to-credit ratio is a measure of how much credit you are using compared to how much credit you have available.

You carry a 1000 balance on your first card and a 2000 balance on your second card. Ad Get a Card with 0 APR Until 2022. But if you have a 1000 limit and a credit card balance of 200.

The amount youll be able to spend using your credit card will depend on the credit limit youre given by your lender. Thats not a good look to creditors. In total you carry a 3000 balance across all of your cards.

Debunking a credit score myth. So its a good idea to try to keep it under 30 which is whats generally recommended. Credit cards offer one of the best ways for you to build your credit and improve your credit scores by showing how you manage credit on a regular basis.

If your credit card number is stolen but not the card you are not responsible for unauthorized. Then multiply by 100 to get 35. Theyll normally decide on your credit limit after running a credit check where they consider your outstanding debts any missed payments and the amount of.

Overall you have a 3000 balance and 6000 in total credit. Putting this into context is. Our Experts Found the Best Credit Card Offers for You.

Lets say you have these credit card balances and credit limits. The result is your overall credit utilization ratio. But that advice isnt a shortcut to improving your credit.

Someone who pays off 1000 on a card with a 5000 limit isnt going to see the same score hike that someone paying off a maxed out card will. Plus the impact that your credit utilization rate has on your credit scores and reports might also depend on a number of other factors. People with exceptional credit scores 800 or higher on the FICO Score range of 300 to 850 tend to keep utilization under 10 for each card and for total credit card use.

But if your 2000-limit card were closed due to inactivity that would bring your utilization up to 50 percent 5001000. According to an Equifax spokesperson the average credit utilization as of June 15 2020 is 192 a historical low since Equifax began tracking the data in 2009. How Does Credit Utilization Affect Your Credit Score.

Always read your terms of use carefully and pay special attention to things like your credit limit your interest rate your yearly fee and any other fees associated with the card. So if you have a 900 limit on one credit card and spend 450 during. To calculate the total credit utilization for these you would divide 2801 by 8000 to get35 after rounding.

If you have a 1000 limit on your credit card and youre carrying a 700 balance at the statement closing date youre using 70 of your available credit. Heres what you need to know. Our Experts Found the Best Credit Card Offers for You.

If you want to build good credit use credit cards regularly while making all your payments on time and using a small portion of your cards credit limit. Generally experts recommend keeping your utilization under 30. The generalized rule is for every open account you have you want your credit utilization to be below 30 percent.

For reference according to recent data the average interest rate on credit cards.

Tips And Tricks To Use Your Credit Card Wisely Calcite Credit Union

Tips And Tricks To Use Your Credit Card Wisely Calcite Credit Union

Should You Use One Credit Card To Pay Off Another Forbes Advisor

Should You Use One Credit Card To Pay Off Another Forbes Advisor

When To Use A Credit Card According To The Pros Real Simple

When To Use A Credit Card According To The Pros Real Simple

5 Credit Cards That Pay You To Use Them Gobankingrates

5 Credit Cards That Pay You To Use Them Gobankingrates

How Often Should I Use My Credit Card Us News

How Often Should I Use My Credit Card Us News

5 Ways To Use Credit Cards Wisely

5 Ways To Use Credit Cards Wisely

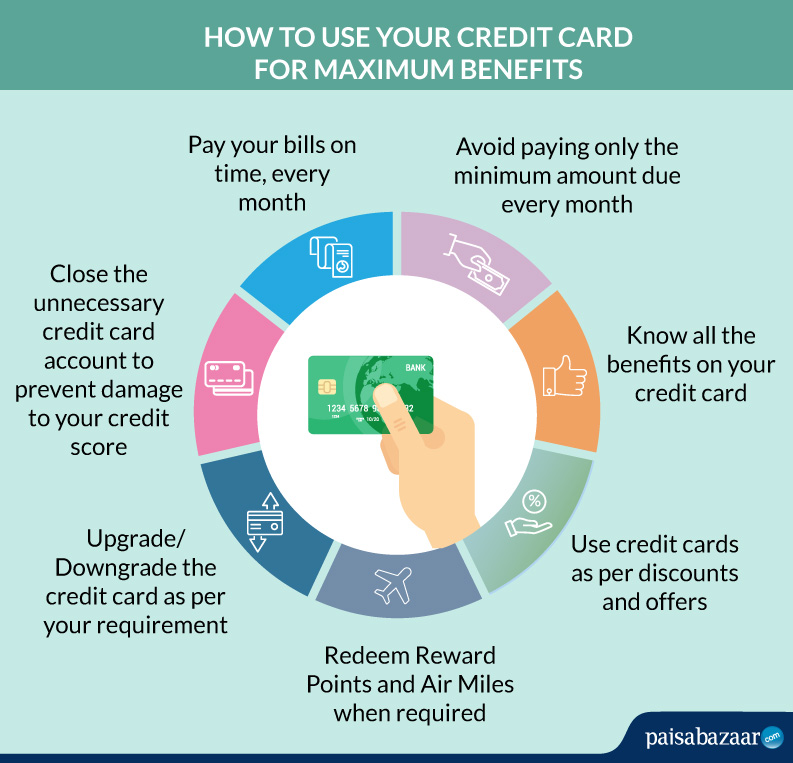

How To Use Your Credit Card For Maximum Benefits Paisabazaar Com 22 April 2021

How To Use Your Credit Card For Maximum Benefits Paisabazaar Com 22 April 2021

Best Ways To Use Credit Cards To Increase Your Credit Score Readwrite

Best Ways To Use Credit Cards To Increase Your Credit Score Readwrite

5 Effective Ways To Use A Credit Card

5 Effective Ways To Use A Credit Card

How To Use A Credit Card Responsibly

How To Use A Credit Card Responsibly

What Are Contactless Credit Cards And How Do I Get One

What Are Contactless Credit Cards And How Do I Get One

:max_bytes(150000):strip_icc()/debit-and-credit-card-tips-in-canada-1481710-Final2-5c2f73e546e0fb00015cfd9b.png) Tips For Using Debit Cards And Credit Cards In Canada

Tips For Using Debit Cards And Credit Cards In Canada

/_How-does-a-prepaid-card-work-960201_Final2-a914cdbc7901430d80de45153461af0a.png) How Does A Prepaid Credit Card Work

How Does A Prepaid Credit Card Work

:max_bytes(150000):strip_icc()/credit-card--concept-credit-card-payment-1156857742-c265746dcaea46e6bcc5f0bcda1ed871.jpg)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.