Ad Search For Relevant Info Results. The number is nine digits long so its similar to a social security number.

Https Ulstercountyny Gov Sites Default Files Documents Nys 20tax 20id 20no Pdf

Of Labor Payment Unit Bldg 12 POB 621 Albany NY 12201 North Carolina - 56-1611838 NC Dept of Revenue PO Box 25000 Raleigh NC 27640 North Dakota - 45-0309764 State of North Dakota 600 E Boulevard Ave Bismark ND 58505-0599.

Ny state tax id. If youre planning on starting a business in New York state youll need to set your business up with the states tax department and the Internal Revenue Service. With an NYgov ID you dont need to enroll for a separate Login ID and password at each new site you visit. There are several ways to conduct a number lookup.

The document numbers for New York State driver licenses and non-driver IDs consist of either 8 or 10 alphanumeric characters we only require the first three characters. You will need your case number from your bill or notice and the following information from an income tax return for one of the last four years. This number is an 8 or 10 digit alphanumeric number located in the lower-right corner of.

Please review Form CT-198. An Employer Identification Number EIN also known as a federal tax identification number identifies a business entity. Step 9 The purchaser will certify the property being purchased is for resale and sign and date the certificate.

Pay using Quick Pay for individuals only Pay directly from your bank account for free. An EIN number lookup in NY is a way to find an Employer Identification Number which is also called a Taxpayer Identification Number. What you will need.

Common abbreviations used are EIN or TIN. The New York State Tax Department will notify you of this identification number by mailing a form CT-198 Corporation Tax Account Information to the address provided by the Department of State. An EIN is a nine-digit number that the Internal Revenue Service assigns to a business.

You may need to report this information on your 2020 federal income tax return. Your New York State Identification Number used for state income tax withholding will be your Federal Employer Identification Number EIN followed by a location code if applicable to your business. Department of Labor Unemployment Insurance Office of Temporary and Disability Assistance MyBenefits.

Click on Apply For A Tax ID EIN Number and select the entity type that best describes your business. If you are concerned with how to get a Tax ID number in New York follow these simple instructions. Get Results from multiple Engines.

Please enable JavaScript to view the page content. Ad Search For Relevant Info Results. Your UI Employer Registration Number will be a 7 or 8-digit account number.

The IRS uses the number to identify taxpayers that are required to file various business tax returns. Publication 20 New York State Tax Guide for New Businesses provides information on New York State rules for corporation taxes withholding taxes for employees workers compensation benefits and much more. To view the standard placement of document numbers on New York State-issued licenses and IDs visit the New York State Department of Motor Vehicles at Sample Photo Documents.

NYgov Business account If you have an Individual NYgov account you will still need to create a NYgov Business account to access New York Business Express. Please enable JavaScript to view the page content. Get Form 1099-G for tax refunds.

Step 8 Out-of-state purchasers will enter their state of registration and sales tax ID number in addition to the merchandise being purchased. Your support ID is. If you received an income tax refund from us for tax year 2019 view and print New York States Form 1099-G on our website.

If youre not sure what category you should select take our brief survey. Generally all businesses need an EIN. The IRS issues all businesses an EIN.

How to Obtain a Tax ID Number in New York State. If youre filing a New York return for tax year 2020 and have a New York-issued ID youre required to enter the document number in addition to your ID number on your New York state return. Delays can occur if the office needs to request additional information.

Get Results from multiple Engines. If you have a 7-digit number enter the number using a dash. Your support ID is.

If you go this route your certificate will arrive within four to six weeks. Harriman Campus Albany NY 12227. If you must register to collect sales tax and need information about how to register see Tax Bulletin How to Register for New York State Sales Tax.

You will likely need a Tax ID number also known as an Employer ID number which is issued at the federal level through the IRS. What Is an Employer Identification Number or EIN. Simply use your NYgov ID Login ID and password to sign into New York State services such as.

If it doesnt show your federal employer identification number EIN. In addition your business will have additional responsibilities and obligations beyond the collection of sales tax. It must be returned to New York State Tax Department Sales Registration Unit WA.

Nys Sales Tax Exempt Form New Resale Certificate Ny Fresh Broadway Ticket Brokers The Nyc Theatre Models Form Ideas

Nys Sales Tax Exempt Form New Resale Certificate Ny Fresh Broadway Ticket Brokers The Nyc Theatre Models Form Ideas

Form Ifta 21 Fillable New York State International Fuel Tax Agreement Ifta Application This Form Replaces Forms Ifta 1 And Ifta 9

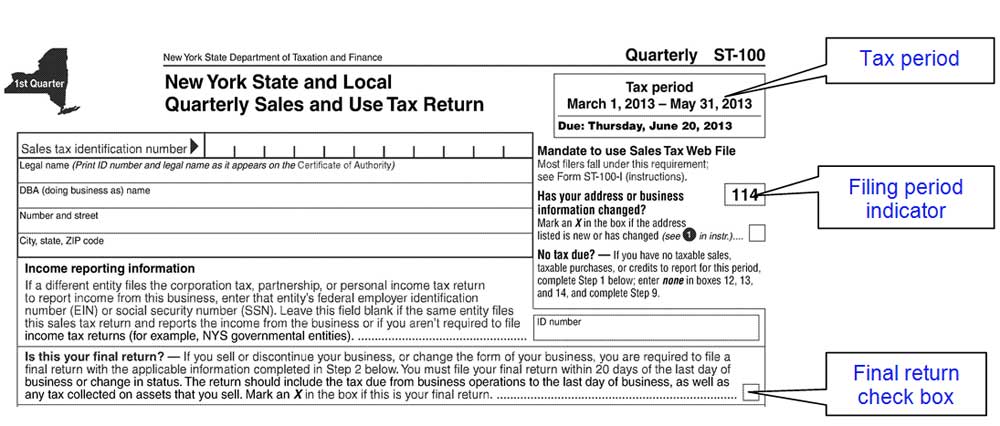

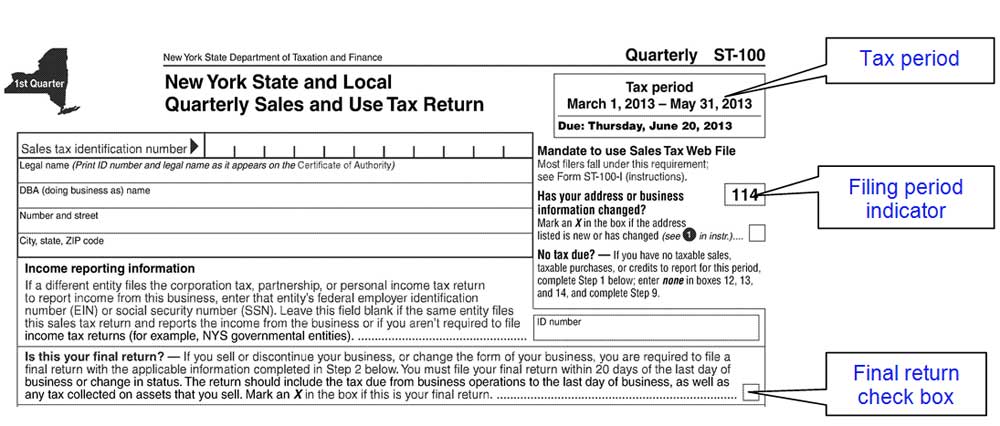

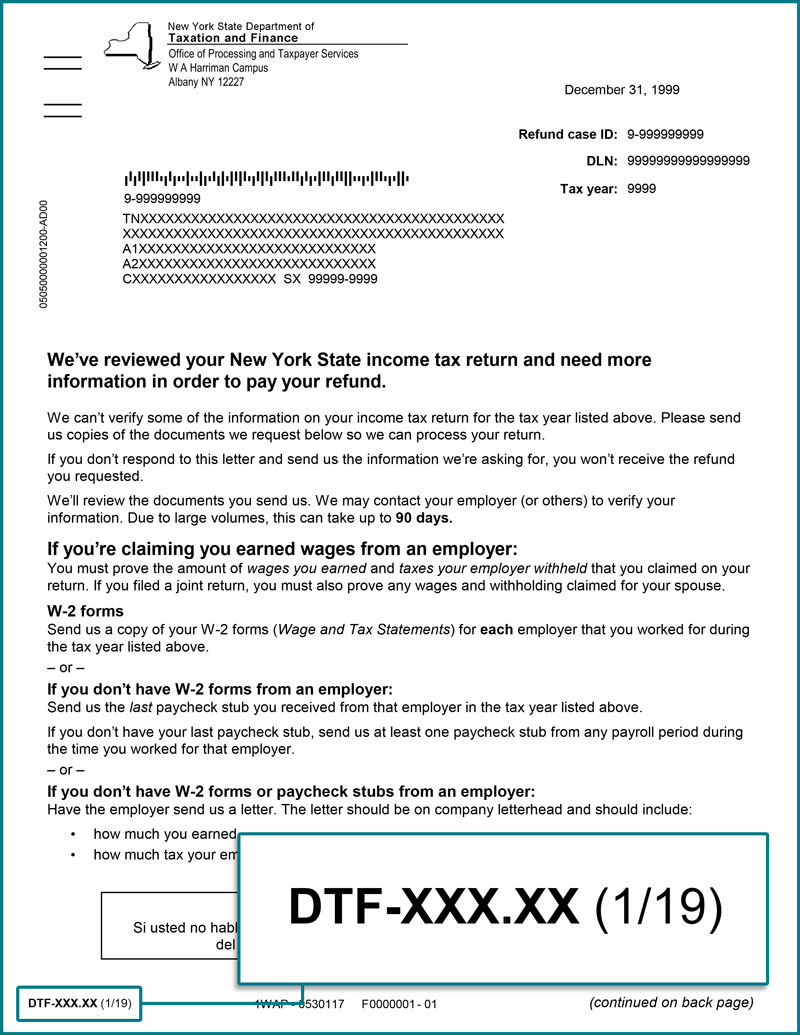

Filing A Final Sales Tax Return

Filing A Final Sales Tax Return

Filing A Final Sales Tax Return

Filing A Final Sales Tax Return

Is Nys Vendor Id Same As A Nys Tax Id Number

Is Nys Vendor Id Same As A Nys Tax Id Number

New York State Tax Bill Sample 2

Fillable Online Tax Ny New York State Department Of Taxation And Finance A00 Annual St 101 New York State And Local Annual Sales And Use Tax Return Sales Tax Identification Number Legal Name

Fillable Online Tax Ny New York State Department Of Taxation And Finance A00 Annual St 101 New York State And Local Annual Sales And Use Tax Return Sales Tax Identification Number Legal Name

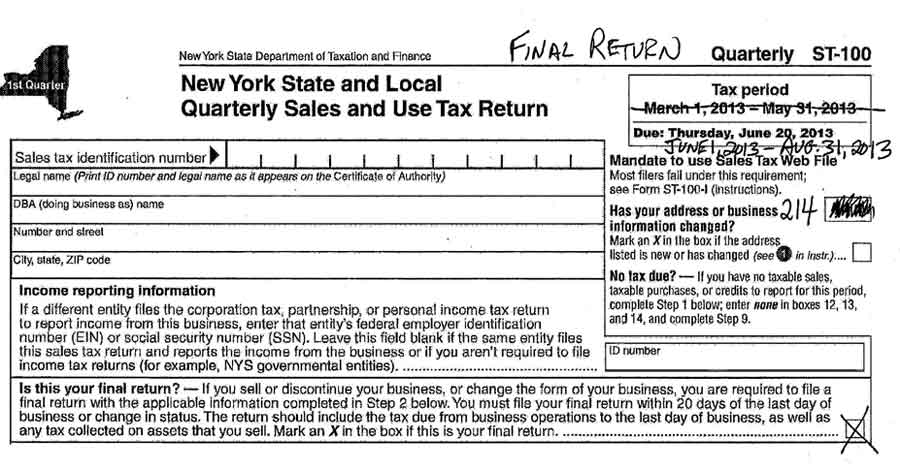

Respond To A Letter Requesting Additional Information

Respond To A Letter Requesting Additional Information

License Ny State And Charging Tax The Office Window Cleaning Resource Community

New York State Tax Bill Sample 2

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.