Key Takeaways Ex-dividend is when a companys dividend allocations have been specified. A dividend is a share of profits and retained earnings that a company pays out to its shareholders.

Introduction To Dividend Powerpoint Slides

Introduction To Dividend Powerpoint Slides

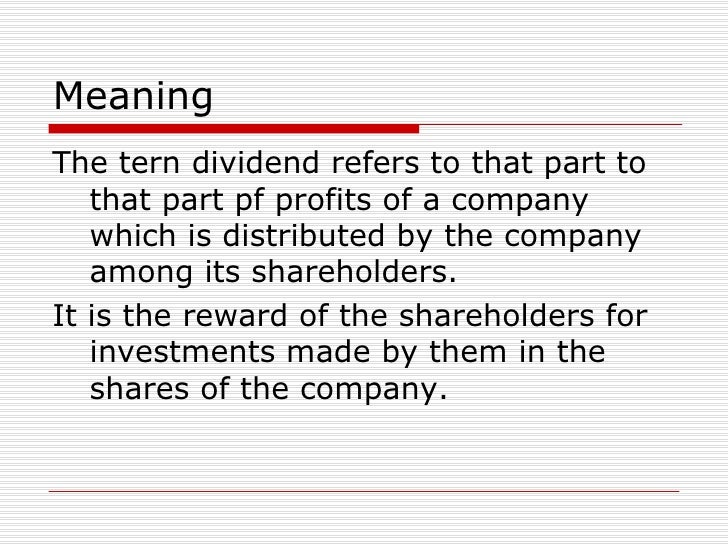

Dividend is sharing of profit of a company with its shareholders.

What is the meaning of dividend. When a company generates a profit and accumulates retained earnings those earnings can be either reinvested in the business or paid out to shareholders as a dividend. Although most companies make quarterly payments in cash checks dividends also may be. Dividend yield is the financial ratio that measures the quantum of cash dividends paid out to shareholders relative to the market value per share.

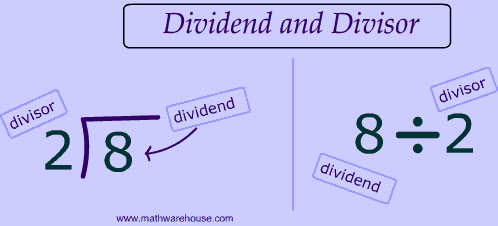

Such as a. A shareholder typically gets two types of return from investment into shares. The amount that you want to divide up.

The dividend is paid in a fixed amount for each share of stock held. When a security is sold ex-dividend the dividend remains with the seller. Definition of Dividend Definition.

The sale of a security after a dividend has been announced but before it has been distributed. Capital appreciation and dividend. Dividend divide divisor quotient Example.

Rather the dividend payment is made to whoever owned the stock the day before the ex-dividend date. In 12 divide 3. A share of a companys net profits distributed by the company to a class of its stockholders.

Selling ex-dividend almost invariably reduces the price for which the security is sold by the amount of the dividend. When a corporation earns a profit or surplus it is able to pay a proportion of the profit as a dividend to shareholders. Dividend arbitrage is an options trading strategy that involves purchasing puts and stock before the ex-dividend date and then exercising the put.

A companys dividend is decided by its board of directors and it requires the shareholders approval. A part of the profit of a company that is paid to the people who own shares in it. Definition of dividend 1.

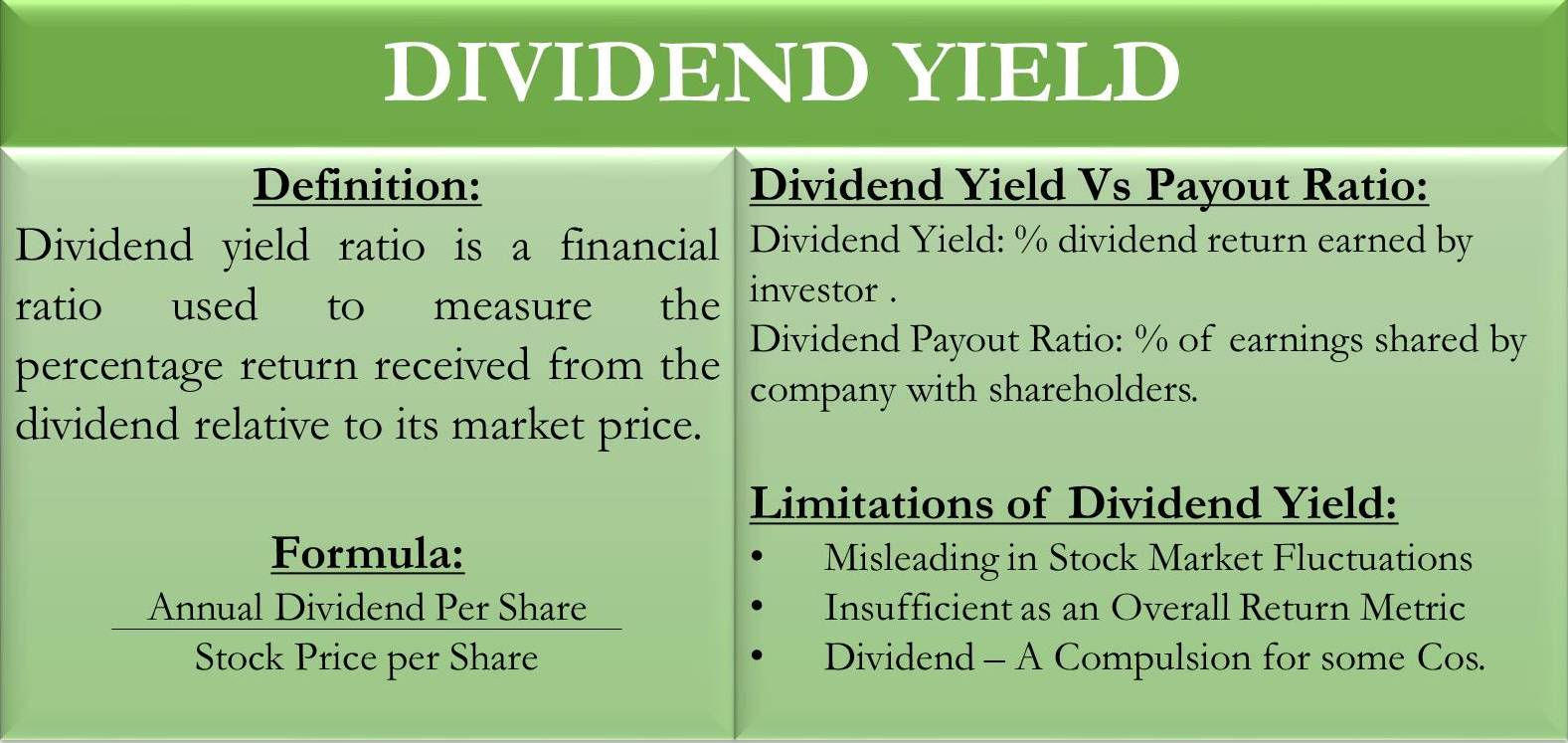

A part of the profit of a company that is paid to the people who own shares in it. An individual share of something distributed. The annual dividend per share divided by the share price is the dividend yield.

Dividend paid is the event when the dividends hit the investors account. Any amount not distributed is taken to be re-invested in the business called retained earnings. When the dividends are paid the dividends payable liability account is removed from the companys balance sheet and the cash account of the company is debited for a similar amount.

Cum dividend Ex-dividend date. Illustrated definition of Dividend. The dividend yielddisplayed as a percentageis the amount of money a company pays shareholders for owning a share of its stock divided by its current stock price.

It is computed by dividing the dividend per share by the market price per share and multiplying the result by 100. Dividends can be issued in various forms such as cash payment stocks or any other form. A dividend is a distribution of profits by a corporation to its shareholders.

Dividend refers to a reward cash or otherwise that a company gives to its shareholders. A share in a pro rata distribution as of profits to stockholders Profits are distributed to shareholders as dividends.

Scrip Dividend Meaning Examples How To Issue Scrip Dividends

Scrip Dividend Meaning Examples How To Issue Scrip Dividends

Define Dividend Page 1 Line 17qq Com

Define Dividend Page 1 Line 17qq Com

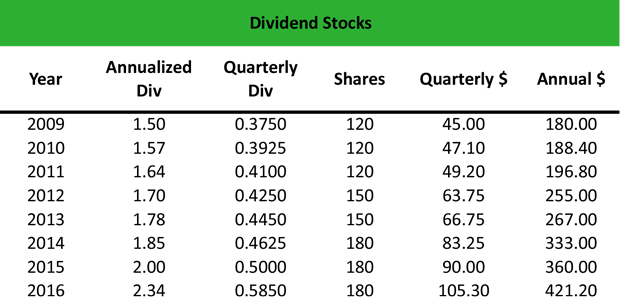

What Are Dividend Stocks Definition Meaning Example

What Are Dividend Stocks Definition Meaning Example

Dividend Yield Efinancemanagement Com

Dividend Yield Efinancemanagement Com

Dheeraj On Twitter Cash Dividends Example Meaning Importance What Is Cash Dividend Https T Co 4yzdzelte1 Cashdividends Cashdividendsexample Cashdividendsmeaning Cashdividendsimportance Https T Co Khjjammtk3

Dheeraj On Twitter Cash Dividends Example Meaning Importance What Is Cash Dividend Https T Co 4yzdzelte1 Cashdividends Cashdividendsexample Cashdividendsmeaning Cashdividendsimportance Https T Co Khjjammtk3

Chapter 7 Dividend Policy Meaning Of Dividend Dividend Refers To The Business Concerns Net Profits Distributed Among The Shareholders It May Also Be Termed Ppt Download

Chapter 7 Dividend Policy Meaning Of Dividend Dividend Refers To The Business Concerns Net Profits Distributed Among The Shareholders It May Also Be Termed Ppt Download

What Is Dividend What Does Dividend Mean Dividend Meaning Definition Explanation Youtube

What Is Dividend What Does Dividend Mean Dividend Meaning Definition Explanation Youtube

Mathematical Definition Of Dividend

Mathematical Definition Of Dividend

/dotdash_Final_Ex_Dividend_Date_vs_Date_of_Record_Whats_the_Difference_Oct_2020-01-6453b1e5c23146779ab4da7df074e8ab.jpg) Comparing Ex Dividend Date Vs Date Of Record

Comparing Ex Dividend Date Vs Date Of Record

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.