It feels great to be proactive knock your taxes out early and relax when all the procrastinators are scrambling to meet the deadline. Youll now have to file a.

When You Need Your Taxes Done Right Help Is A Phone Call Away Location Does Not Matter We Prepare U S Federal All Tax Preparation Income Tax Tax Refund

When You Need Your Taxes Done Right Help Is A Phone Call Away Location Does Not Matter We Prepare U S Federal All Tax Preparation Income Tax Tax Refund

End of April for CDN returns.

When do you have to have your taxes done by. TurboTax Online accounts are differentiated by user ID and e-mail address. Its best to make an appointment now. As you can imagine many of the sites are BUSY BUSY BUSY.

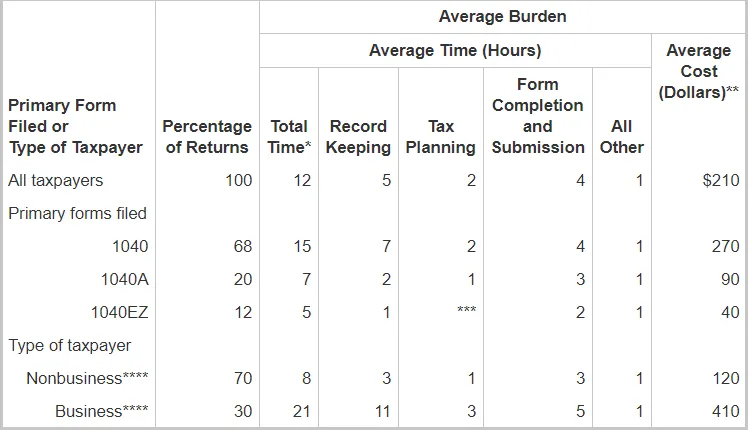

If you are on a J-1 visa working as an au pair you may need to file estimated taxes using form 1040ES-NR. Those who filed a 1040EZ averaged 5 hours but filing form 1040 took the average taxpayer 16 hours. As a result if you did not get your stimulus payment s yet or you didnt receive the full amount owed you will have to file a 2020 tax return to claim your payment.

Estimates for the 2020 tax year wont be available until filing season 2021 gets underway. If you used TurboTax Online to file prior year tax returns please ensure you are consistently using the same TurboTax Online account each time you sign in and on each device you use. By now you should have your W-2s or 1099s along with any interest statements and are already envisioning that tax refund in your hot little hands.

April 15 is the due date for all 2020 tax returns but filing your taxes sooner will not only potentially speed up delivery of any tax refund you might collect but also position you to get any. Getting ready long before the April 15 due date also means youll have plenty of time to do your research. Review the specific filing requirements if you are a foreign exchange student or visiting scholar.

For the 2020 tax year the IRS has extended the filing deadline to July 15. Reported time can vary significantly for individual taxpayers. Despite having extra time your best bet is to schedule a tax prep day as early as possible.

For those who have a business rental property or other investments to report the average price is going to be around 75 per return. Volunteers who are certified by the IRS can help seniors prepare and electronically file their income tax forms. The Campaign for Working Families a Philly-based non-profit group is helping residents file current returns with a virtual tax preparation portal.

Start to prepare and eFile your 2020 Tax. However the good news is that even if youre accountant doesnt get to your taxes ASAP they will get them done before the April 17 deadline and the burden is effectively off of your plate. April 15 2021 May 17 2021 will be the postponed tax deadline or Tax Day for 2020 Tax Returns.

Many users have more than one account and dont even know it. Of course the amount of time youll spend will depend on the complexity of your financial situation but the IRS estimated that the average person required about 11 hours to prepare their 2019 tax return. You can use form 1040NR to file a tax return.

If youre asking for help on a myriad of financial topics you can expect to pay about 350-500 to get your taxes done but that includes advice as well. If you cant file your. Full-Time Tax Pros aka your local CPA.

According to the National Society of Accountants it will run you an average of 294 per return to work with a CPA. Our volunteers do simple income tax returns - if you own two homes a yacht and have some offshore bank accounts you may want to consider having your taxes done by a professional accountant. Or whether you can just use the latest tax software and do them yourself.

The latest 2020 Tax Return deadlines are listed here for the 2020 return due in 2021. But with all the ways to get your taxes prepared you might be wondering if you should be using a private certified public accountant CPA or an enrolled agent EA. See detailed state related tax deadline and payment information.

The best rule of thumb is to go with a professional if your tax situation is daunting. If you have no idea how taxes work have never prepared a tax return dont have time to complete the tax. The return has to be received by CRA by the due date not just mailed.

Remember you now have until July 15 2020 to file your federal tax return and claim refunds. In Canada they have to be in by the end of March. Several users also dont realize they are using a different account each year.

However if you have self-employment income the deadline to file is June 15th but any taxes owing are still due on April 30th. If youre expecting a refund she suggests making a plan for where the refund will go. In 2014 an IRS Publication 1040 reported an average time burden of 13 hours to do the record-keeping planning filing and submission of tax forms.

Insider tip - if you want to try to get away with a walk-in appointment wait a few. The IRS runs the Volunteer Income Tax Assistance VITA program for individuals who make less than 51000 and need help preparing their tax forms. If you decide to file your own tax return you could be able to do it without paying anything at all.

For most people that should get their taxes done by a professional versus those that simply do but dont need to a.

/tax-preparation-prices-and-fees-3193048_color22-02e553ad83d64fb6803944caea928d8b.gif) How Much Is Too Much To Pay For Tax Returns

How Much Is Too Much To Pay For Tax Returns

3 Places To Go To Get Your Taxes Done In 2021 Part Time Money

3 Places To Go To Get Your Taxes Done In 2021 Part Time Money

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

6 Reasons You Still Haven T Done Your Taxes Rags To Reasonable

6 Reasons You Still Haven T Done Your Taxes Rags To Reasonable

How Early Can You File Your Taxes To Get Your Tax Refund

How Early Can You File Your Taxes To Get Your Tax Refund

5 Things To Do If You Haven T Filed Your Taxes Infographic

5 Things To Do If You Haven T Filed Your Taxes Infographic

15 Tax Questions In Canada Answered Tax Time Tax Checklist Tax Preparation

15 Tax Questions In Canada Answered Tax Time Tax Checklist Tax Preparation

3 Smart Ways To Get Your Taxes Done On Time Levy Tax Help

3 Smart Ways To Get Your Taxes Done On Time Levy Tax Help

What To Do If You Made A Mistake On Your Taxes Time

What To Do If You Made A Mistake On Your Taxes Time

6 Ways To Get Your Taxes Done For Free

6 Ways To Get Your Taxes Done For Free

What You Should Know If You Need More Time To File Your Taxes Arizona Small Business Association

What You Should Know If You Need More Time To File Your Taxes Arizona Small Business Association

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

Tax Preparation Fees How Much Does It Cost To Have Your Taxes Done

Tax Preparation Fees How Much Does It Cost To Have Your Taxes Done

Is It Worth The Money To Have Someone Do My Taxes Women Who Money

Is It Worth The Money To Have Someone Do My Taxes Women Who Money

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.