Living in New York City adds more of a strain on your paycheck than living in the rest of the state as the Big Apple imposes its own local income tax on top of the state one. See Refund amount requested to learn how to locate this amount.

New York State Mistake Panics Taxpayers

New York State Mistake Panics Taxpayers

File Your New York State Income Tax Return Eligible New Yorkers have more free e-file options than ever with brand-name Free File software.

Nyc state tax. Social Security number and. In New York two new personal income tax brackets would be temporarily created. New York will delay its state income tax filing deadline to May 17.

New York States top marginal income tax rate of 882 is one of the highest in the country but very few taxpayers pay that amount. The city income tax rates vary from year to year. Beer and Liquor Tax.

New York State Income Tax. Cuomo announced the lowest middle-class tax rates in 70 years are expected to save New Yorkers 22 billion in 2021 and assist with recovery from pandemic economic hardship. Sales Tax Web File.

New York Business Express. Personal income tax in New York is on a progressive system with eight brackets ranging from 4 percent up to 882 percent which is only paid by people earning more than 1 million a year. Para español llámenos al 518-457-5149oprima el dos.

Overview of New York Taxes. New York City residents would pay a top rate of 147 in state and local taxes the highest income tax rate in the nation Cuomo said Tuesday in an address unveiling his 2022 budget. Business tax e-file mandates for partnership sales and corporation tax filers.

Enter the amount of the New York State refund you requested. Bloomberg via Getty Images. The Following New York City Taxes are collected by New York State instead of New York City.

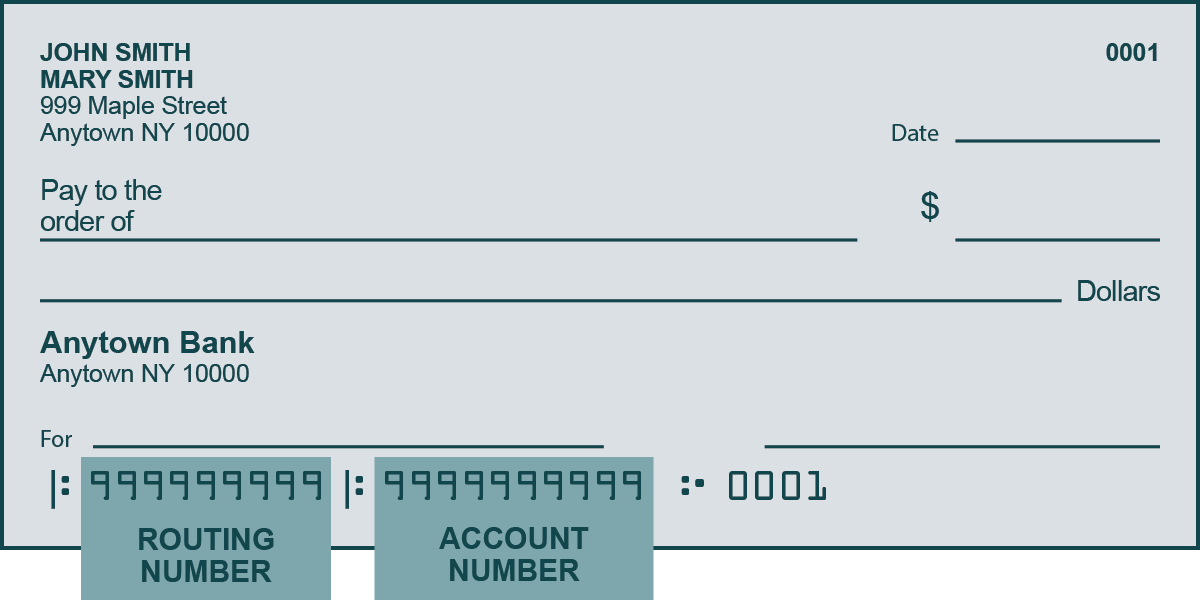

New York state has a progressive income tax system with rates ranging from 4 to 882 depending on taxpayers income level and filing status. Pay using Quick Pay for individuals only Pay directly from your bank account for free. New York City has a separate city income tax that residents must pay in addition to the state income tax.

Motor Vehicle Registration Tax. The state applies taxes progressively as does the federal government with higher earners paying higher rates. New York City Income Tax.

Select the tax year for the refund status you want to check. SAVE TO MY SERVICES SAVED. ALBANY New York will push back its state income tax filing deadline for.

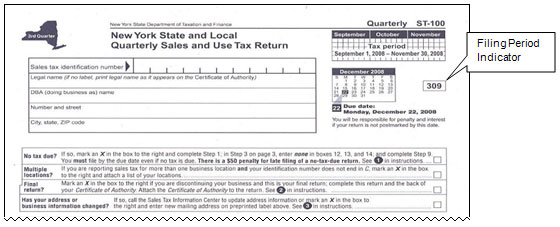

Use Sales Tax Web File to schedule payments in advance save your bank account information for future payments and receive instant confirmation when we receive your return. The tax rate youll pay depends on your income level and filing status and its based on your New York State taxable income. For general and filing information visit the New York State Department of Taxation and Finance.

The New York Department of Revenue is responsible for publishing the latest New York State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in New York. Enter your Social Security number. Choose the form you filed from the drop-down menu.

Personal Income Tax and Non-resident NYC. 103 percent for income between 5 million and 25 million and. Tax rates and thresholds are typically reviewed and published annually in the year proceeding the new tax.

You will need your case number from your bill or notice and the following information from an income tax return for one of the last four years.

Do States Like New York And California Really Have High Taxes Quora

Http Nysac Membershipsoftware Org Files Nysactaxwhitepaper 1 Pdf

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

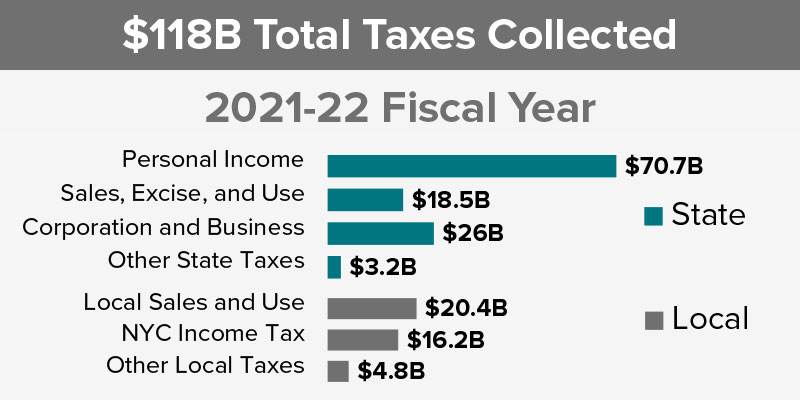

Total Receipts Office Of The New York State Comptroller

Total Receipts Office Of The New York State Comptroller

Https Www Empirecenter Org Wp Content Uploads 2018 04 Rdb Pit Ejm April 2018 Update Pdf

New York State Tax Bill Sample 2

Filing Period Indicators On Final Sales Tax Returns

Filing Period Indicators On Final Sales Tax Returns

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

Do You Owe New York State Taxes How To Avoid Penalties With Ny S Voluntary Disclosure Program

Do You Owe New York State Taxes How To Avoid Penalties With Ny S Voluntary Disclosure Program

Albany Boosts Taxes On Wealthiest Wsj

Albany Boosts Taxes On Wealthiest Wsj

Receive Your New York State Tax Refund Up To Two Weeks Sooner

Receive Your New York State Tax Refund Up To Two Weeks Sooner

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.