Up to 50 of total financing package. Complete the 3508S Form if you.

SBA Export Working Capital Program.

Key bank sba loans. Small Business Administration SBA 7a lending program and additional lenders approved by the Department of Treasury. Alaska Industrial Development and Export Authority AIDEA Small Business Administration SBA loans. Paycheck Protection Program An SBA-backed loan that helps businesses keep their workforce employed during the COVID-19 crisis.

Small Business Administration the highest bank designation reserved for top-tier lenders. Complete the 3508EZ Form if you. Real estate heavy equipment and other fixed assets.

SBA Definition of a Small Business The SBA defines a small business as one that. Loan amounts up to 5 million. As an experienced SBA lender in the area we can determine if an SBA loan is the best option for you and easily walk you through the entire process.

You can apply for the Paycheck Protection Program PPP at any lending institution that is approved to participate in the program through the existing US. Together with your affiliates didnt receive PPP loans totaling 2000000 or more. Government-backed term loan for the acquisition or expansion of a small business.

SBA 7 a Business Loan Key benefits. KeyBank believes small business loans are at the heart of a growing economy. The Paycheck Protection Program PPP is a loan designed to provide a.

Small Business Administration SBA loans are designed to be accessible to small businesses that might not otherwise qualify for conventional loans. Compared to conventional loans SBA loans have many key benefits that make them an attractive option for small businesses. In addition to Northrim business loans we have expertise in loan participations with.

Terms up to 7. Learn more about the requirements to see if your business could qualify. Alaska Housing Finance Corporations AHFC multi-family loan program.

After Key issues its forgiveness decision to the SBA the SBA has 90 days to remit the forgiveness amount to Key. Complete an application PDF or stop by your local branch to apply. In SBA Loans by Key Commercial CapitalApril 3 2020 DOWNLOAD PDF.

Lakeland Bank is recognized as a Preferred Lender by the US. Physical Damage Loans. American National Bank is proud to be a Preferred Lender of Small Business Administration SBA loans in Northeast Wisconsin.

The small business bankers at your local KeyBank branch have access to our team of SBA Loan Specialists who are ready to assist you to help your business grow. Key must issue a decision to the SBA on a loan forgiveness application not later than 60 days after receipt of a complete loan forgiveness application from the borrower. Nearly any business-related purpose.

EZ Loan SBA Express Loan. We are here to help answer specific questions and offer advice on your options. Received a PPP loan of 150000 or less AND.

Up to 5 million. Business Purchases Other Purposes. USChamber-SBA Loan-Guide The Coronavirus Aid Relief and Economic Security CARES Act allocated 350 billion to help small businesses keep workers employed amid the pandemic and economic downturn.

Here is an overview of the different Small Business Administration SBA Forgiveness Applications for the Paycheck Protection Program PPP. Terms up to 10 years for business acquisition equipment or tenant improvement. Our local branches have SBA Specialists that focus only on SBA loans so you can get the personal attention you need.

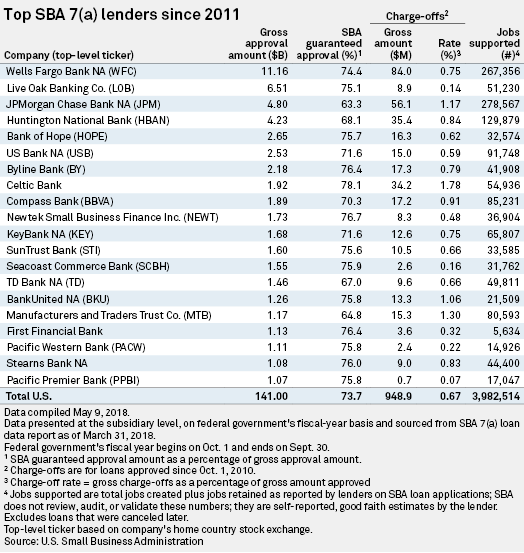

Upfront costs for export businesses. State Trade Expansion Program STEP SBA associated awards. KeyBank is a Top SBA 7 a Lender in the Nation and also has been designated as a Preferred Lender for more than 20 years.

1 st Deed Financing. In SBA Loans by Key Commercial Capital April 3 2020 Where can I apply for the Paycheck Protection Program. KeyBank offers Small Business Administration loans in Alaska Colorado Connecticut Idaho Indiana Maine Massachusetts Michigan New Jersey New Hampshire New York Ohio Oregon Pennsylvania.

By early afternoon Friday about 4000 PPP loans had been submitted to about 400 banks nationally for a total of 14 billion according to SBA data. Economic Injury Disaster Loan. Loan Interest Rate Loans will be subject to an interest rate of 1 not 05 as stated in materials previously published by the SBA or 4 the cap stated in the CARES Act.