With only a bachelors and no Big 4 experience the most you can probably hope to make is 45-50k. These privileges are also awarded to enrolled agents and attorneys.

What Can A Cpa Do That An Accountant Can T Myrqb

What Can A Cpa Do That An Accountant Can T Myrqb

They do bookkeeping financial planning and prepare financial documents like tax returns and profit-and-loss statements.

What can a cpa do that an accountant can t. In a nutshell a CPA is an accountant but not all accountants are CPAs. Ad Study the CPA Program with the level of support you need to succeed. If the accountant isnt acting in a professional or ethical manner.

They are usually responsible for the accuracy of an organizations financial health. An enrolled agent can prepare a clients tax return heshe just can not represent the client in front of IRS but CPA can. Study the CPA Program with the level of support you need to succeed.

Study the CPA Program with the level of support you need to succeed. An accountant can help you get to know the cash flow trends that your business experiences. A Certified Public Accountant CPA is an accountant who also meets the educational and experience requirements of the state they live in and has passed that states Uniform CPA Exam.

Reasons to Take Action. The one thing a CPA can do is issue an opinion on audited reviewed or compiled financial statements. Accountants do the routine work and they can complete tax returns while CPAs are responsible for analyzing the work representing you at a tax audit and helping you make more high-level business and tax decisions.

So What Can a CPA Do that an Accountant Cant. While most small businesses may never require an audited or reviewed financial statement public companies must produce audited statements. The one thing a CPA can do is issue an opinion on audited reviewed or compiled financial statements.

Some of these roles. Even in public accounting not all functions require CPA license. They can use their expert knowledge of taxes to minimize the chances of such an auditand if there is one they can represent you.

However CPAs are alternatively responsible for analyzing the work representing you and on the behalf of your business at a tax audit and helping you make more high-level business and tax decisions. Generally licensed accountants are what you might expect they are responsible for keeping financial matters smooth and up-to-date. If the accountant isnt responsive to your needs by not responding to concerns answering questions quickly and completely or ignoring phone calls.

What Is a CPA. An accountant is a professional who takes care of all of the boringum essentialmath tasks that go along with running a business. You are required to have a CPA license to provide attest services.

I recently asked this question to an accountant with both a CPA and Big 4 experience and the response I received was. What can a Certified Public Accountant CPA do that an accountant or bookkeeper wo CPA cannot do. And how can they help your business.

Predominately accountants typically perform the routine work and they can complete tax returns. Unlike an ordinary accountant a CPA has the distinction of providing you with tax planning and tax preparation. If you are wary of a tax audit from the IRS there are few smarter moves you can make than hiring a CPA.

A CPA and EA will have the most knowledge of the tax laws and both can represent you and your business before the IRS in. However a CPA can do two things that an accountant without a CPA license cannot. Furthermore CPA cannot represent client in tax court a tax attorney can.

All public companies must file audited financial statements with the SEC. An accountant without the CPA designation cannot do any of these things. Prepare audited or reviewed financial statements and file a report with the Securities and Exchange Commission SEC.

In public accounting a public accountant can perform a variety of roles. They can monitor the ebb and flow and help you predict when a cash flow crisis might be imminent and help you take steps to mitigate. We cant become experts if were spread too thin.

A CPA is allowed to sign a clients tax return as a paid preparer and represent the client in front of the IRS. In turn we refer tax work back to them which also lowers our risk. Theyre also comfortable sending clients to us because they know that we wont solicit tax work.

The IRS gives certified public accountants special privileges that non-certified accountants dont get. A bookkeeper can help you manage your payroll taxes sales taxes and compile 1099s but only an accountant CPA or EA can file your tax returns for you. Ad Study the CPA Program with the level of support you need to succeed.

A Certified Public Accountant is allowed to perform certain duties that regular accountants are not permitted to do such as preparing an audited financial statement or acting as a taxpayer or company representative in discussion with IRS Revenue Officers or Counsel. Thus a symbiotic win-win relationship is born. Any qualified public accountant can do most of these tasks.

When bookkeeping is done properly accountants can achieve a higher recovery. Lets just assume I wont get my CPA and wont work at the Big 4. If your accountant is asking you to do things or telling you heshe is going to do things you feel are not ethical you shouldnt work with that person.

Only a CPA can prepare an audited financial statement or a reviewed financial statement although any accountant can prepare a compiled financial statement. A CPA license is required to provide attest services.

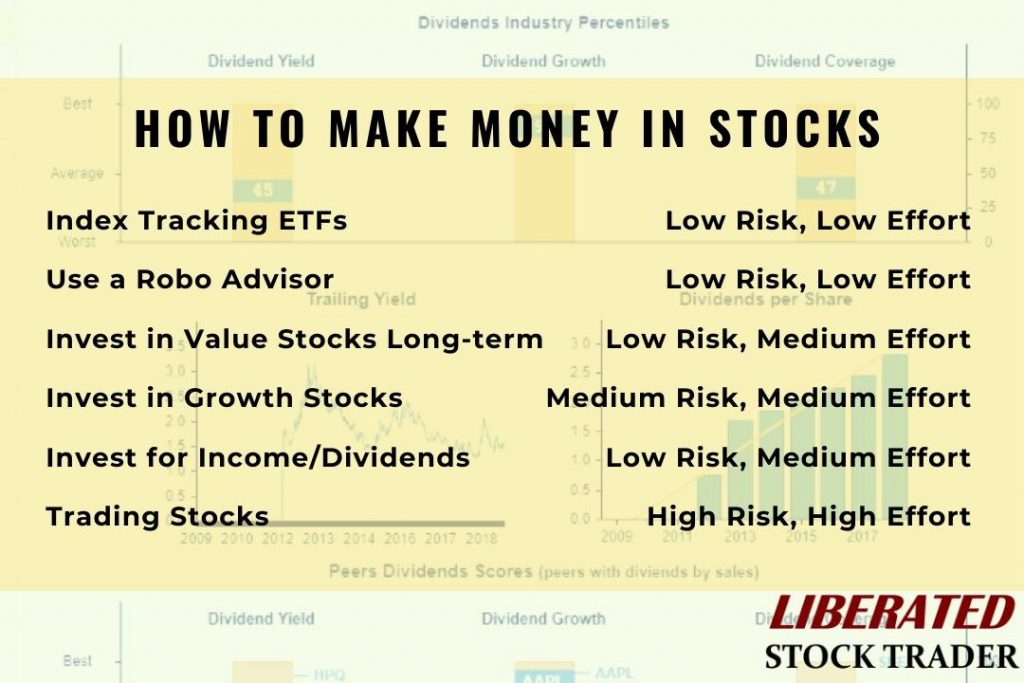

/is-it-possible-to-make-a-living-trading-stocks-3140573_final_AC-01-5c06fa1fc9e77c0001ade06b.png)