Theres probably not much from 2020 you want to remember but heres our tax refund schedule if you are still looking for it. If you receive all or part of your income or pay some or all of your expenses in foreign currency you must translate the foreign currency into US.

Dollar unless you are required to use the currency of a.

Irs accepted return but not approved 2020. You can check online to see if the IRS got your 2020 tax return and what the status of your refund could be if youre getting one. Or other advertiser and have not been reviewed approved or. But this is still just an estimate based on past IRS refund schedules and not a guarantee.

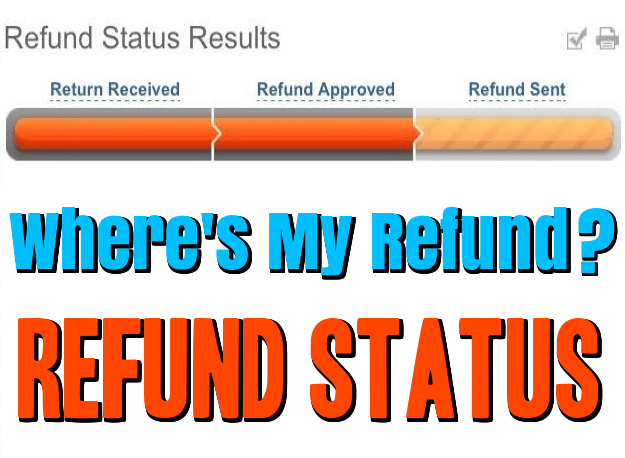

Your functional currency generally is the US. You must express the amounts you report on your US. The tool tracks your return from Return Received the IRS has accepted and is processing it to Refund Approved to Refund Sent.

My refund status says accepted but not approved its been 3 weeks. Further if it takes 21 days on average for 90 of tax payers it also takes a lot longer than that for 10 or over 15 million tax filers to see their refund. Make changes to your 2020 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312023.

The IRS doesnt send an acceptance notification for paper returns. Most 2019 federal income tax returns have been processed. You can check your tax refund status online to see if the IRS got your 2020 tax return and how big your refund could be if youre getting one.

Reason for Tax Refund Delay. Once your tax return has been accepted it will remain the same until the IRS sets your direct deposit and check date then moves your tax return status to Refund Approved The IRS is still only guaranteeing your tax refund within 21 days of Return Accepted status. In 2020 the IRS issued guidance that 90 of tax filers might be reimbursed in 21 reporting days.

The IRS expects the earliest EITCACTC related refunds to be available in taxpayer bank accounts or debit cards starting February 27 2019 if these taxpayers chose direct deposit. But the lingering problems are significant enough that the House Ways and Means Committee is asking the IRS for answers and. Most of the refunds are still going to be.

The earliest you could file a 2020 tax return was Jan. You Claim Certain Credits. If you filed your tax return manually then you may or may not be affected since it takes a while for the IRS to enter the returns into the computer this is done by hand and can take some time depending on the.

During the refund season the IRS operates on holidays so this means 21 days not working days only. 2020 IRS Refund Schedule. Katie Conner April 18 2021 1100 am.

An acceptance from the IRS or an approval of a refund does not mean that your return will not be selected for audit. You can track returns online using the IRS Wheres My Refund tool. All your tax return was accepted means that it passed a basic test of having a valid social security number and other data.

Tax Topic 152 ensures you get a refund for taxes. The IRS has processed your return and confirmed the amount of your refund if youre owed one. Reasons you havent received your refund can range from simple math errors on your return to identity theft and tax fraud.

The first thing to verify your tax return was accepted electronically and verify the date your tax return was accepted by the IRS. Read on for more reasons your refund may be delayed. It updates once every 24 hours so theres no point in checking more frequently.

For TurboTax Live Full Service your tax expert will amend your 2020 tax return for you through 11302021. So the earliest date anyone could expect to get a refund this year was Feb. Tax return in US.

If your 2020 tax return status filed in 2021 is still being processed after you have filed your return the IRS has confirmed that they are backlogged on processing and issuing refunds. What Does Topic 152 Mean. How you do this depends on your functional currency.

As the IRS often notes for nine out of ten tax payers it takes a maximum of 21 days to receive a tax refund when eligible after their tax return has been accepted. Terms and conditions may vary and are subject to change without notice. As many of the taxpayers must have known that IRS has started accepting returns on January 27th 2020.

Tax Return Accepted By IRS Refund Status Approved by IRS Direct Deposit Sent Paper Check Mailed Feb 8 2021. Your return is deemed accepted as soon as the IRS receives and processes it. If your tax return is accepted and if youre entitled to a refund your tax return may be marked approved for purposes of releasing the funds.

Or it might simply mean unusually high processing volume at the IRS. Your refund is now on its way to your bank via direct deposit or as a. You can check your tax refund status online to see if the IRS has received your 2020 tax return and the size your refund could be if youre getting one.

One tangential thing to remember is that the IRS does not accept tax returns before a certain date.